Authors

Summary

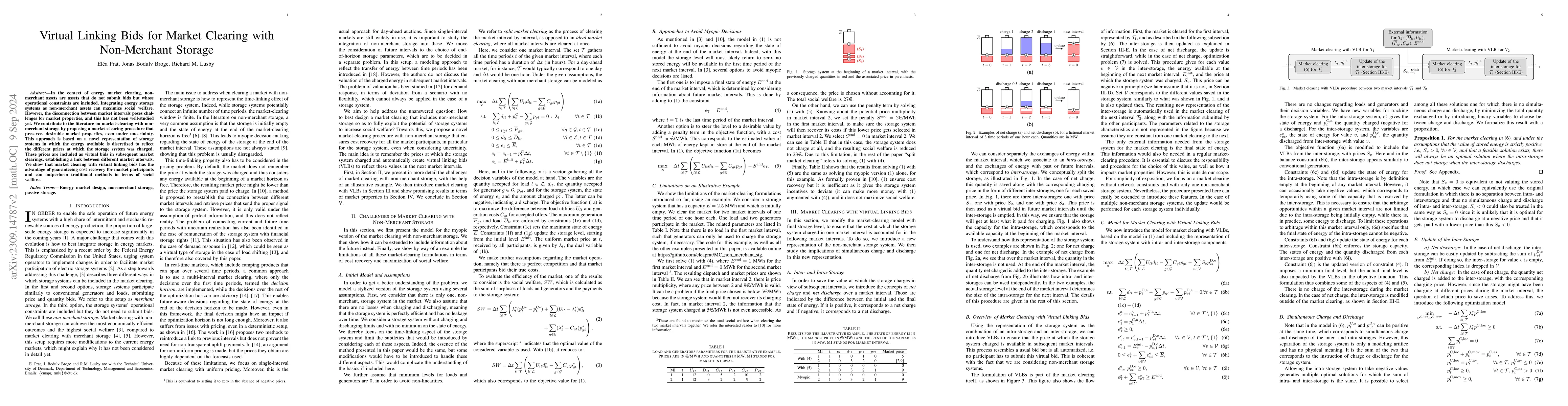

In the context of energy market clearing, non-merchant assets are assets that do not submit bids but whose operational constraints are included. Integrating energy storage systems as non-merchant assets can maximize social welfare. However, the disconnection between market intervals poses challenges for market properties, that are not well-considered yet. We contribute to the literature on market-clearing with non-merchant storage by proposing a market-clearing procedure that preserves desirable market properties, even under uncertainty. This approach is based on a novel representation of the storage system in which the energy available is discretized to reflect the different prices at which the storage system was charged. These prices are included as virtual bids in the market clearing, establishing a link between different market intervals. We show that market clearing with virtual linking bids outperforms traditional methods in terms of cost recovery for the market participants and discuss the impacts on social welfare.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvexifying Market Clearing of SoC-Dependent Bids from Merchant Storage Participants

Cong Chen, Lang Tong

Convexifying Regulation Market Clearing of State-of-Charge Dependent Bid

Cong Chen, Lang Tong, Siying Li

On the Efficiency of Energy Markets with Non-Merchant Storage

Jalal Kazempour, Pierre Pinson, Linde Frölke et al.

Wholesale Market Participation of Storage with State-of-Charge Dependent Bids

Cong Chen, Lang Tong

No citations found for this paper.

Comments (0)