Authors

Summary

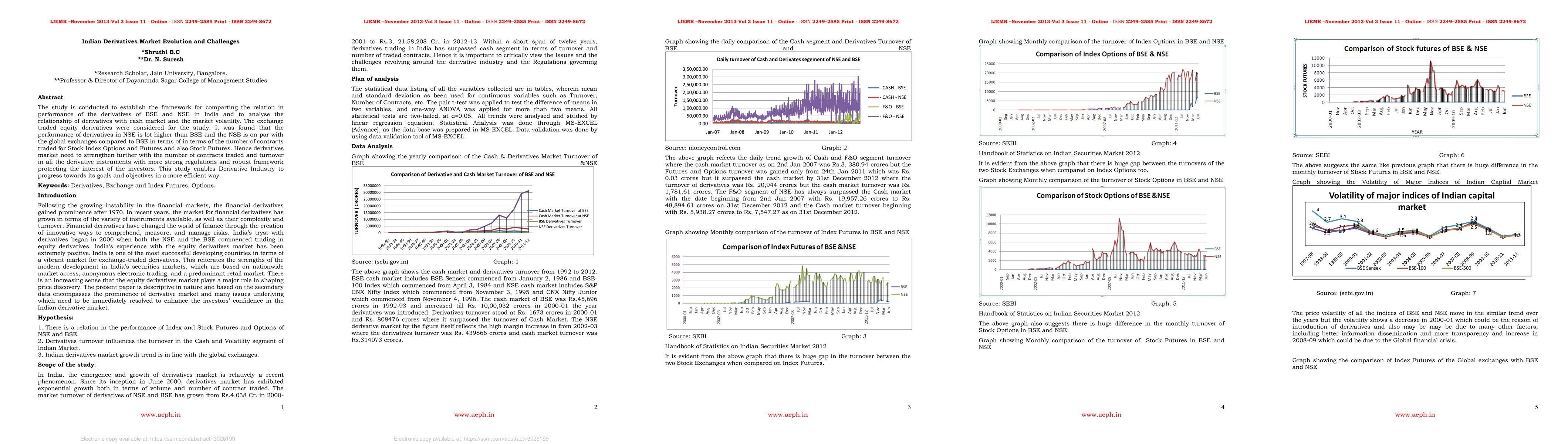

The study is conducted to establish the framework for comparing the relation in performance of the derivatives of BSE and NSE in India and to analyse the relationship of derivatives with the cash market and the market volatility. The exchange-traded equity derivatives were considered for the study. It was found that the performance of derivatives in NSE is a lot higher than in BSE and the NSE is on par with the global exchanges compared to BSE in terms of the number of contracts traded for Stock Index Options and Futures and also Stock Futures. Hence derivatives market needs to strengthen further with the number of contracts traded and turnover in all the derivative instruments with more strong regulations and a robust framework protecting the interest of the investors. This study enables Derivative Industry to progress towards its goals and objectives in a more efficient way.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)