Summary

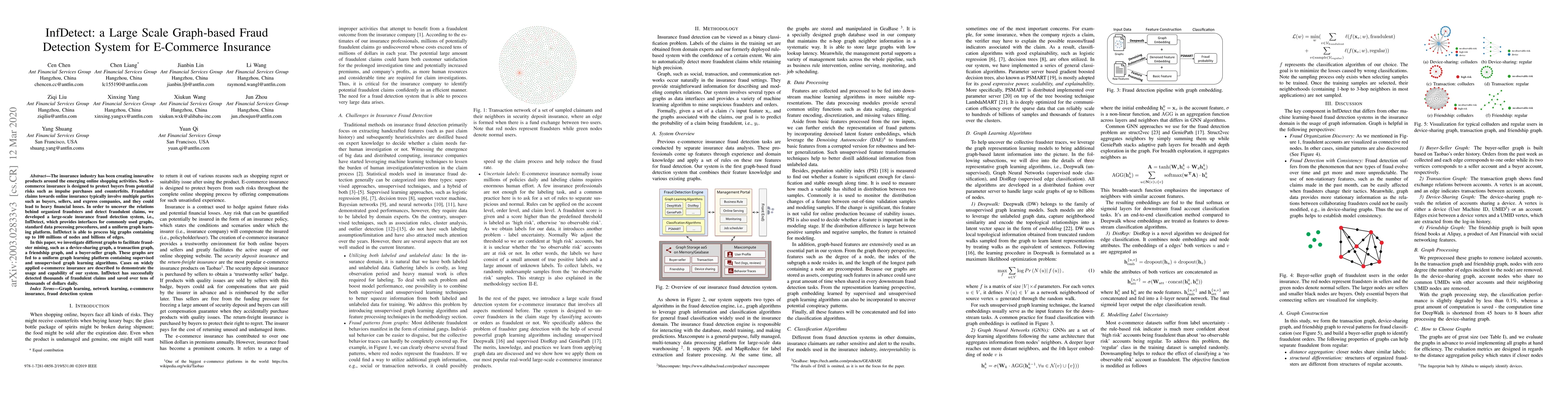

The insurance industry has been creating innovative products around the emerging online shopping activities. Such e-commerce insurance is designed to protect buyers from potential risks such as impulse purchases and counterfeits. Fraudulent claims towards online insurance typically involve multiple parties such as buyers, sellers, and express companies, and they could lead to heavy financial losses. In order to uncover the relations behind organized fraudsters and detect fraudulent claims, we developed a large-scale insurance fraud detection system, i.e., InfDetect, which provides interfaces for commonly used graphs, standard data processing procedures, and a uniform graph learning platform. InfDetect is able to process big graphs containing up to 100 millions of nodes and billions of edges. In this paper, we investigate different graphs to facilitate fraudster mining, such as a device-sharing graph, a transaction graph, a friendship graph, and a buyer-seller graph. These graphs are fed to a uniform graph learning platform containing supervised and unsupervised graph learning algorithms. Cases on widely applied e-commerce insurance are described to demonstrate the usage and capability of our system. InfDetect has successfully detected thousands of fraudulent claims and saved over tens of thousands of dollars daily.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBehavioral graph fraud detection in E-commerce

Yang Zhao, Hang Yin, Yilmazcan Ozyurt et al.

Fraud detection and risk assessment of online payment transactions on e-commerce platforms based on LLM and GCN frameworks

Xiaotong Zhu, Nanxi Wang, RuiHan Luo

| Title | Authors | Year | Actions |

|---|

Comments (0)