Authors

Summary

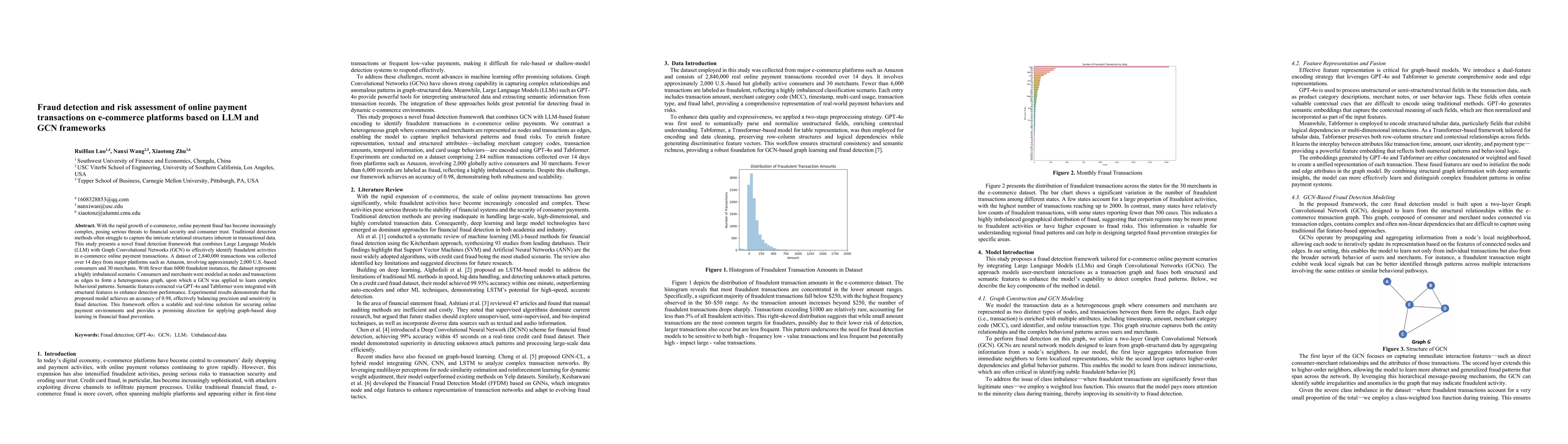

With the rapid growth of e-commerce, online payment fraud has become increasingly complex, posing serious threats to financial security and consumer trust. Traditional detection methods often struggle to capture the intricate relational structures inherent in transactional data. This study presents a novel fraud detection framework that combines Large Language Models (LLM) with Graph Convolutional Networks (GCN) to effectively identify fraudulent activities in e-commerce online payment transactions. A dataset of 2,840,000 transactions was collected over 14 days from major platforms such as Amazon, involving approximately 2,000 U.S.-based consumers and 30 merchants. With fewer than 6000 fraudulent instances, the dataset represents a highly imbalanced scenario. Consumers and merchants were modeled as nodes and transactions as edges to form a heterogeneous graph, upon which a GCN was applied to learn complex behavioral patterns. Semantic features extracted via GPT-4o and Tabformer were integrated with structural features to enhance detection performance. Experimental results demonstrate that the proposed model achieves an accuracy of 0.98, effectively balancing precision and sensitivity in fraud detection. This framework offers a scalable and real-time solution for securing online payment environments and provides a promising direction for applying graph-based deep learning in financial fraud prevention.

AI Key Findings

Generated Oct 12, 2025

Methodology

The study combines Large Language Models (LLM) and Graph Convolutional Networks (GCN) to detect fraud in e-commerce transactions. It constructs a heterogeneous graph with consumers and merchants as nodes and transactions as edges, integrating semantic and structural features using GPT-4o and Tabformer for enhanced detection.

Key Results

- The model achieves an accuracy of 0.98, with high precision for non-fraudulent transactions and low false negatives in fraud detection.

- Fraudulent transactions are predominantly in low-value ranges, with most falling below $250, indicating a need for sensitivity to both small and large-value frauds.

- The framework effectively balances precision and sensitivity, demonstrating robustness in handling highly imbalanced datasets.

Significance

This research addresses the growing complexity of online payment fraud by integrating semantic understanding with graph-based learning, offering a scalable solution for real-time fraud detection in e-commerce environments.

Technical Contribution

The integration of LLM-driven semantic features with GCN structural analysis provides a novel approach for capturing complex fraud patterns in transaction networks.

Novelty

This work uniquely combines Large Language Models (LLM) with Graph Convolutional Networks (GCN) to leverage both semantic and structural information, enhancing fraud detection in highly imbalanced e-commerce datasets.

Limitations

- High false positive rate, with 31,726 legitimate transactions incorrectly flagged as fraudulent.

- Reliance on a single dataset, limiting generalizability to other platforms or regions.

Future Work

- Explore dynamic graph modeling to adapt to evolving fraud patterns.

- Incorporate multimodal behavioral data to improve recall without sacrificing precision.

Paper Details

PDF Preview

Similar Papers

Found 4 papersLLM-Enhanced Self-Evolving Reinforcement Learning for Multi-Step E-Commerce Payment Fraud Risk Detection

Yang Zhao, Zhen Xu, Yinan Shan et al.

Comments (0)