Summary

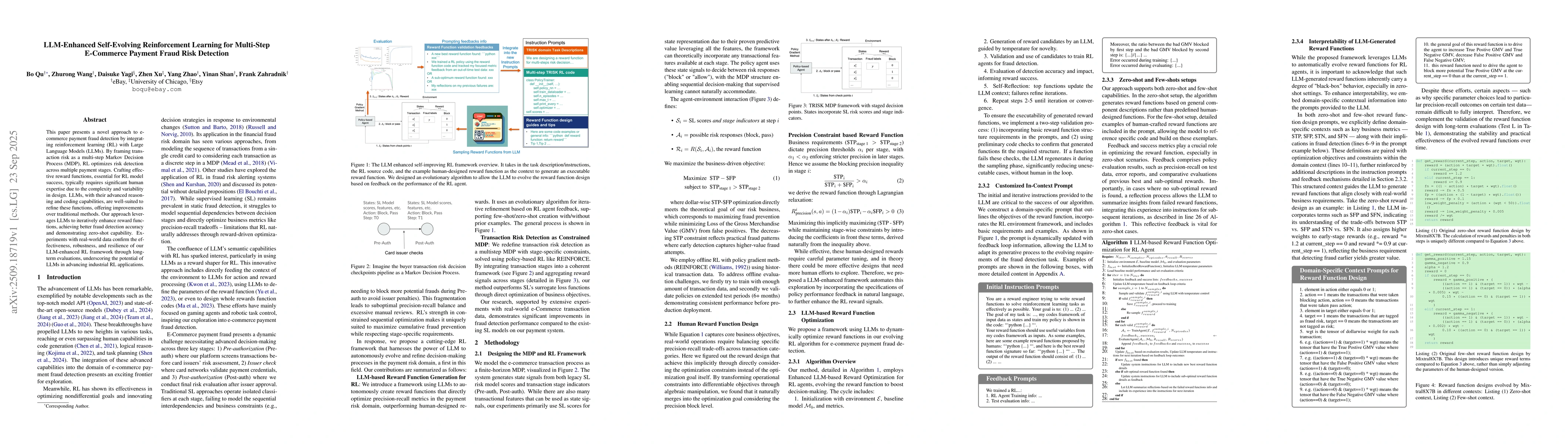

This paper presents a novel approach to e-commerce payment fraud detection by integrating reinforcement learning (RL) with Large Language Models (LLMs). By framing transaction risk as a multi-step Markov Decision Process (MDP), RL optimizes risk detection across multiple payment stages. Crafting effective reward functions, essential for RL model success, typically requires significant human expertise due to the complexity and variability in design. LLMs, with their advanced reasoning and coding capabilities, are well-suited to refine these functions, offering improvements over traditional methods. Our approach leverages LLMs to iteratively enhance reward functions, achieving better fraud detection accuracy and demonstrating zero-shot capability. Experiments with real-world data confirm the effectiveness, robustness, and resilience of our LLM-enhanced RL framework through long-term evaluations, underscoring the potential of LLMs in advancing industrial RL applications.

AI Key Findings

Generated Sep 29, 2025

Methodology

The research employs a reinforcement learning framework enhanced by large language models (LLMs) to design reward functions for fraud detection in financial transactions. The methodology involves iterative reward function generation, validation, and refinement using feedback from training and evaluation metrics.

Key Results

- The proposed framework significantly improves fraud detection performance compared to baseline models, achieving higher precision and recall.

- LLMs demonstrate effectiveness in generating diverse and optimized reward functions that adapt to different stages of transaction processing.

- The system successfully balances the trade-off between blocking risky transactions and minimizing false positives through dynamic reward adjustments.

Significance

This research addresses critical challenges in fraud detection by integrating advanced LLM capabilities with reinforcement learning, offering a scalable solution for real-time financial security. Its potential impact includes enhanced fraud prevention systems and improved decision-making in high-stakes environments.

Technical Contribution

The technical contribution lies in the development of a novel LLM-enhanced reinforcement learning framework that automates and optimizes reward function design for fraud detection tasks, enabling adaptive and context-aware decision-making.

Novelty

This work introduces a unique integration of large language models with reinforcement learning for reward function generation, which differs from traditional rule-based or manually designed approaches by leveraging LLMs' ability to synthesize complex and context-sensitive reward structures.

Limitations

- The framework's performance is highly dependent on the quality and quantity of training data, which may limit its applicability in data-scarce scenarios.

- The interpretability of LLM-generated reward functions remains a challenge, potentially complicating integration with existing financial systems.

Future Work

- Exploring the use of multi-modal data (e.g., transaction metadata, user behavior) to further enhance reward function design.

- Investigating methods to improve the interpretability and transparency of LLM-generated reward functions for regulatory compliance.

- Extending the framework to handle more complex fraud patterns and adversarial scenarios.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFraud detection and risk assessment of online payment transactions on e-commerce platforms based on LLM and GCN frameworks

Xiaotong Zhu, Nanxi Wang, RuiHan Luo

Benchmarking Offline Reinforcement Learning Algorithms for E-Commerce Order Fraud Evaluation

Chris Jones, Soysal Degirmenci

Comments (0)