Summary

Identifying the instances of jumps in a discrete-time-series sample of a jump diffusion model is a challenging task. We have developed a novel statistical technique for jump detection and volatility estimation in a return time series data using a threshold method. The consistency of the volatility estimator has been obtained. Since we have derived the threshold and the volatility estimator simultaneously by solving an implicit equation, we have obtained unprecedented accuracy across a wide range of parameter values. Using this method, the increments attributed to jumps have been removed from a large collection of historical data of Indian sectorial indices. Subsequently, we have tested the presence of regime-switching dynamics in the volatility coefficient using a new discriminating statistic. The statistic has been shown to be sensitive to the transition kernel of the regime-switching model. We perform the testing using the Bootstrap method and find a clear indication of presence of multiple regimes of volatility in the data. A link to all Python codes is given in the conclusion. The methodology is suitable for analyzing high-frequency data and may be applied for algorithmic trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

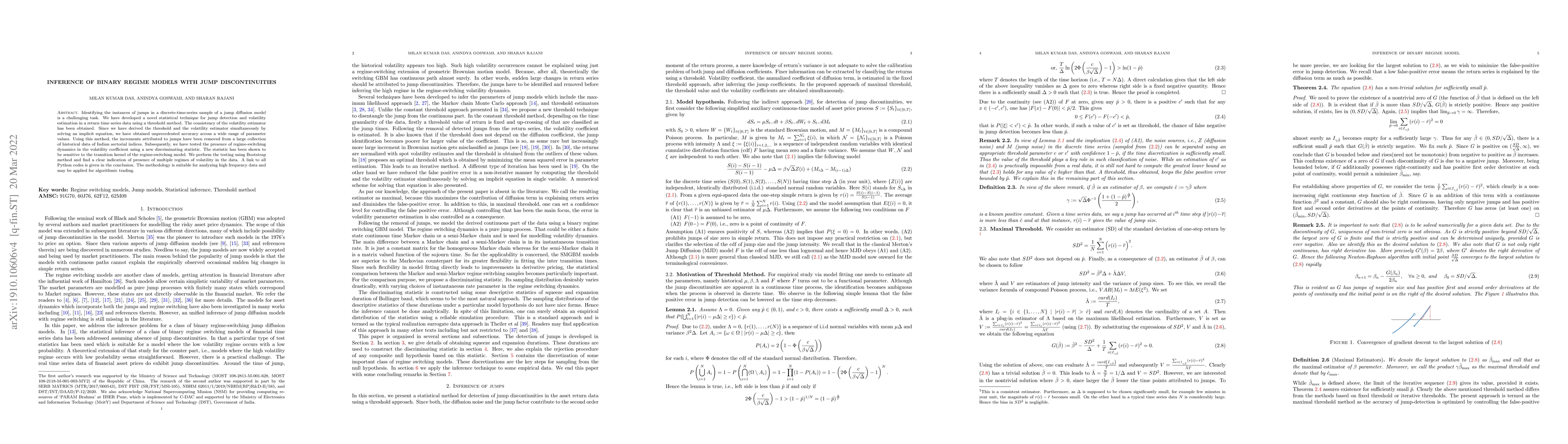

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)