Summary

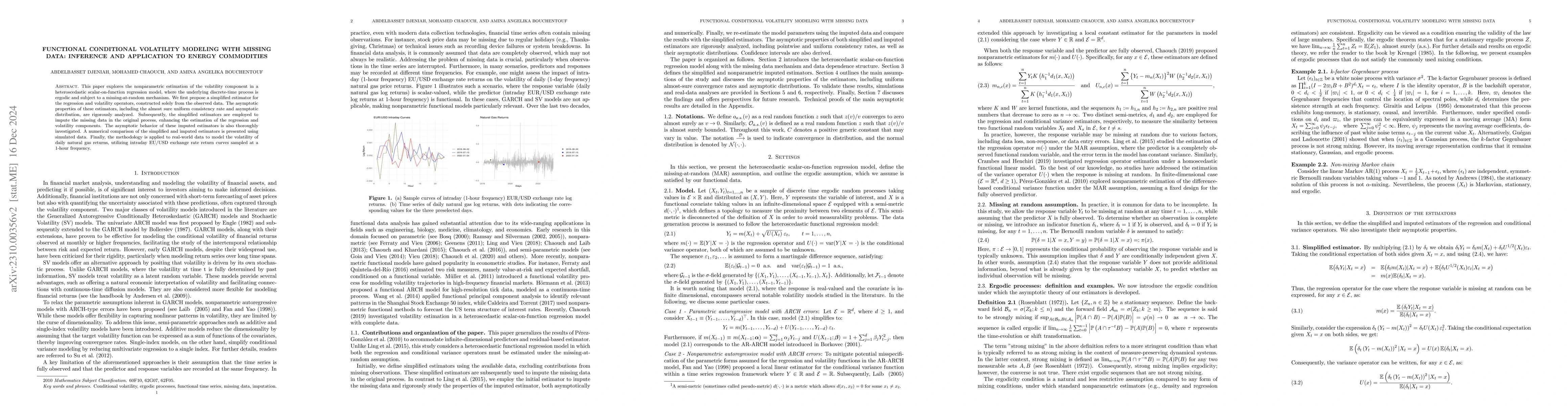

This paper aims to investigate nonparametric estimation of the volatility component in a heteroscedastic scalar-on-function regression model when the underlying discrete-time process is ergodic and affected by a missing at random mechanism. First, we introduce a simplified estimator of the regression and volatility operators based on observed data only. We study their asymptotic properties, such as almost sure uniform consistency rate and asymptotic distribution. Then, the simplified estimators are used to impute the missing data in the original process in order to improve the estimation of the regression and volatility components. The asymptotic properties of the imputed estimators are also investigated. A numerical comparison between the estimators is discussed through simulated data. Finally, a real-data analysis is conducted to model the volatility of daily Brent crude oil returns using intraday, 1-minute frequency, natural gas returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersInterpolation of Missing Swaption Volatility Data using Gibbs Sampling on Variational Autoencoders

Ivo Richert, Robert Buch

No citations found for this paper.

Comments (0)