Authors

Summary

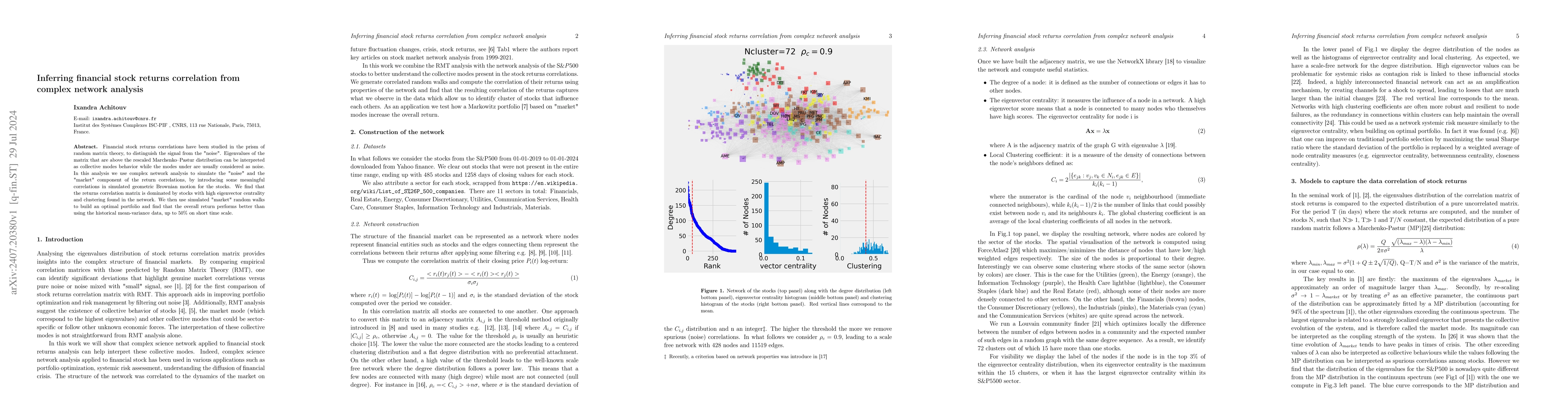

Financial stock returns correlations have been studied in the prism of random matrix theory, to distinguish the signal from the "noise". Eigenvalues of the matrix that are above the rescaled Marchenko Pastur distribution can be interpreted as collective modes behavior while the modes under are usually considered as noise. In this analysis we use complex network analysis to simulate the "noise" and the "market" component of the return correlations, by introducing some meaningful correlations in simulated geometric Brownian motion for the stocks. We find that the returns correlation matrix is dominated by stocks with high eigenvector centrality and clustering found in the network. We then use simulated "market" random walks to build an optimal portfolio and find that the overall return performs better than using the historical mean-variance data, up to 50% on short time scale.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)