Summary

Firm financials are well established as return predictors, being the inspiration for a large set of anomalies in the asset pricing literature. Employing topological data analysis we revisit the question of association between seven of the most commonly studied financial ratios and stock returns. Specifically the TDA Ball Mapper algorithm is applied to visualise the point cloud of financial ratios as an abstract two-dimensional graph readily allowing for identification of interdependencies between factors. These relationships are seldom monotonic, opportunities for investors to profitably exploit this knowledge provided by TDA abound. Clear potential offered by the tools of TDA to shed new light on asset pricing models is demonstrated. Scope for benefit is limited only by the availability of information to the analyst.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

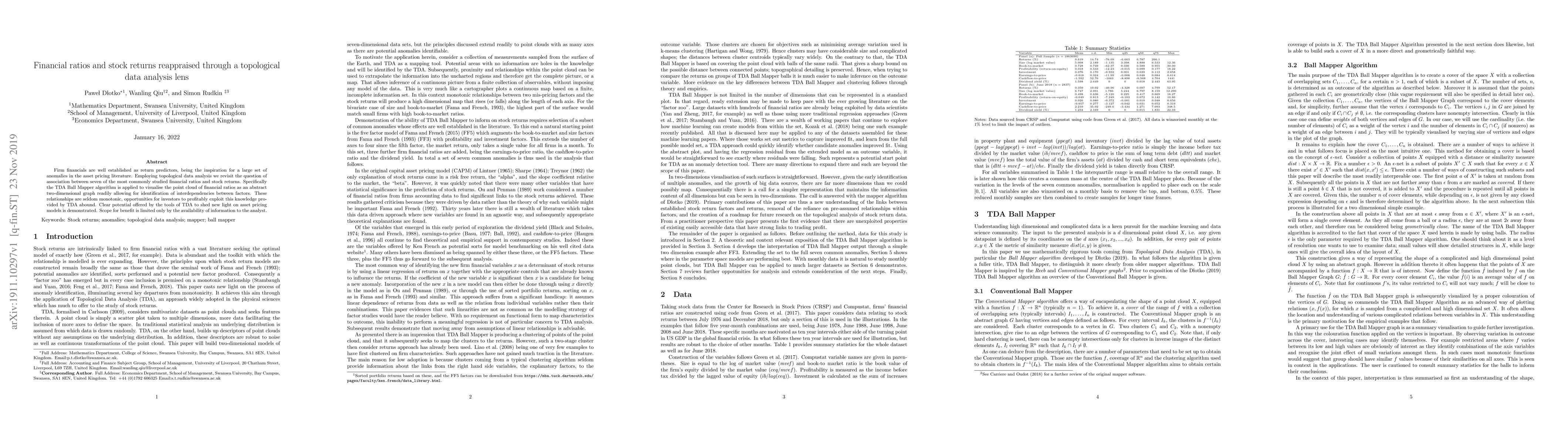

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInvestigation of Indian stock markets using topological data analysis and geometry-inspired network measures

Sunil Kumar, Hirdesh K. Pharasi, Anirban Chakraborti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)