Authors

Summary

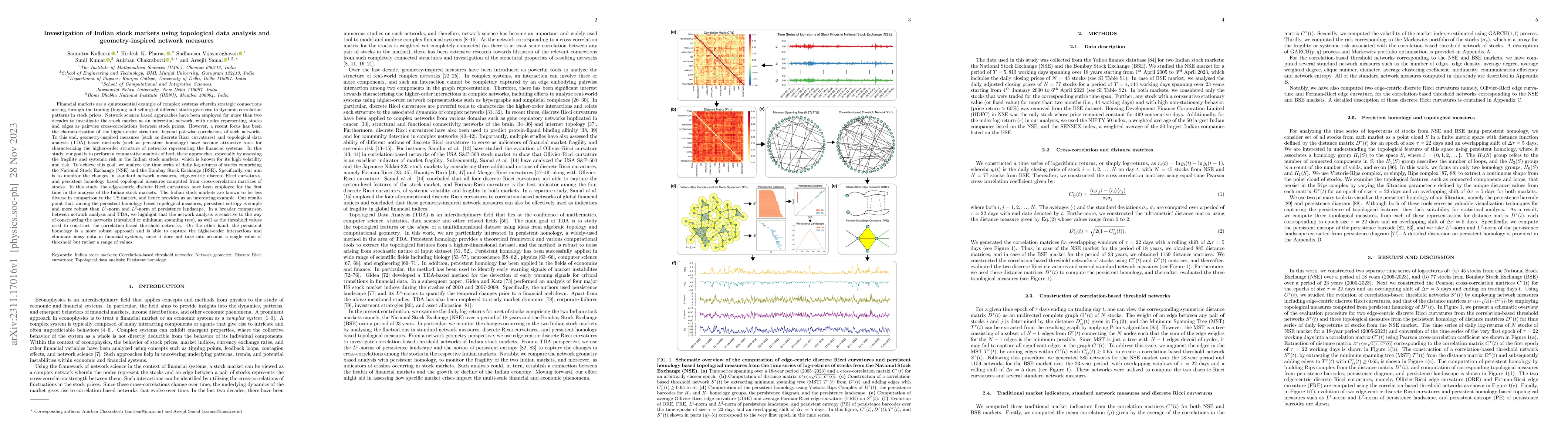

Geometry-inspired measures (such as discrete Ricci curvatures) and topological data analysis (TDA) based methods (such as persistent homology) have become attractive tools for characterizing the higher-order structure of networks representing the financial systems. In this study, our goal is to perform a comparative analysis of both these approaches, especially by assessing the fragility and systemic risk in the Indian stock markets, which is known for its high volatility and risk. To achieve this goal, we analyze the time series of daily log-returns of stocks comprising the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Specifically, our aim is to monitor the changes in standard network measures, edge-centric discrete Ricci curvatures, and persistent homology based topological measures computed from cross-correlation matrices of stocks. In this study, the edge-centric discrete Ricci curvatures have been employed for the first time in the analysis of the Indian stock markets. The Indian stock markets are known to be less diverse in comparison to the US market, and hence provides us an interesting example. Our results point that, among the persistent homology based topological measures, persistent entropy is simple and more robust than $L^1$-norm and $L^2$-norm of persistence landscape. In a broader comparison between network analysis and TDA, we highlight that the network analysis is sensitive to the way of constructing the networks (threshold or minimum spanning tree), as well as the threshold values used to construct the correlation-based threshold networks. On the other hand, the persistent homology is a more robust approach and is able to capture the higher-order interactions and eliminate noisy data in financial systems, since it does not take into account a single value of threshold but rather a range of values.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Price Prediction using Sentiment Analysis and Deep Learning for Indian Markets

Yogesh Agarwal, Narayana Darapaneni, Anwesh Reddy Paduri et al.

Causality Analysis of COVID-19 Induced Crashes in Stock and Commodity Markets: A Topological Perspective

Sushovan Majhi, Anish Rai, Buddha Nath Sharma et al.

Explaining Indian Stock Market through Geometry of Scale free Networks

Pawanesh Yadav, Niteesh Sahni, Charu Sharma

| Title | Authors | Year | Actions |

|---|

Comments (0)