Summary

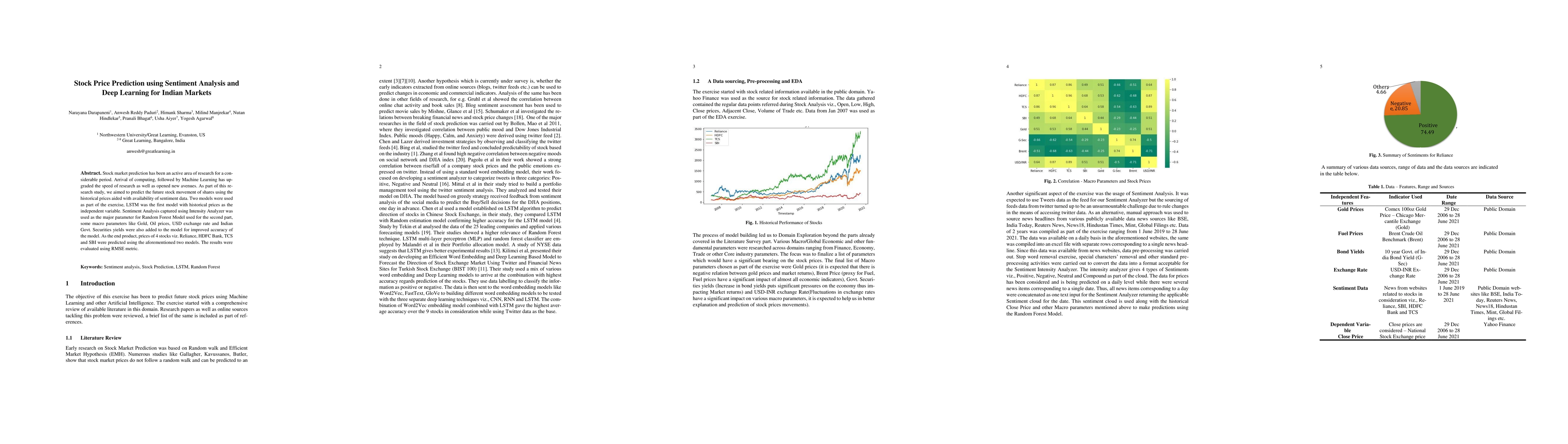

Stock market prediction has been an active area of research for a considerable period. Arrival of computing, followed by Machine Learning has upgraded the speed of research as well as opened new avenues. As part of this research study, we aimed to predict the future stock movement of shares using the historical prices aided with availability of sentiment data. Two models were used as part of the exercise, LSTM was the first model with historical prices as the independent variable. Sentiment Analysis captured using Intensity Analyzer was used as the major parameter for Random Forest Model used for the second part, some macro parameters like Gold, Oil prices, USD exchange rate and Indian Govt. Securities yields were also added to the model for improved accuracy of the model. As the end product, prices of 4 stocks viz. Reliance, HDFC Bank, TCS and SBI were predicted using the aforementioned two models. The results were evaluated using RMSE metric.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinBERT-LSTM: Deep Learning based stock price prediction using News Sentiment Analysis

Shayan Halder

News-Driven Stock Price Forecasting in Indian Markets: A Comparative Study of Advanced Deep Learning Models

Mukesh Tripathi, Kaushal Attaluri, Srinithi Reddy et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)