Summary

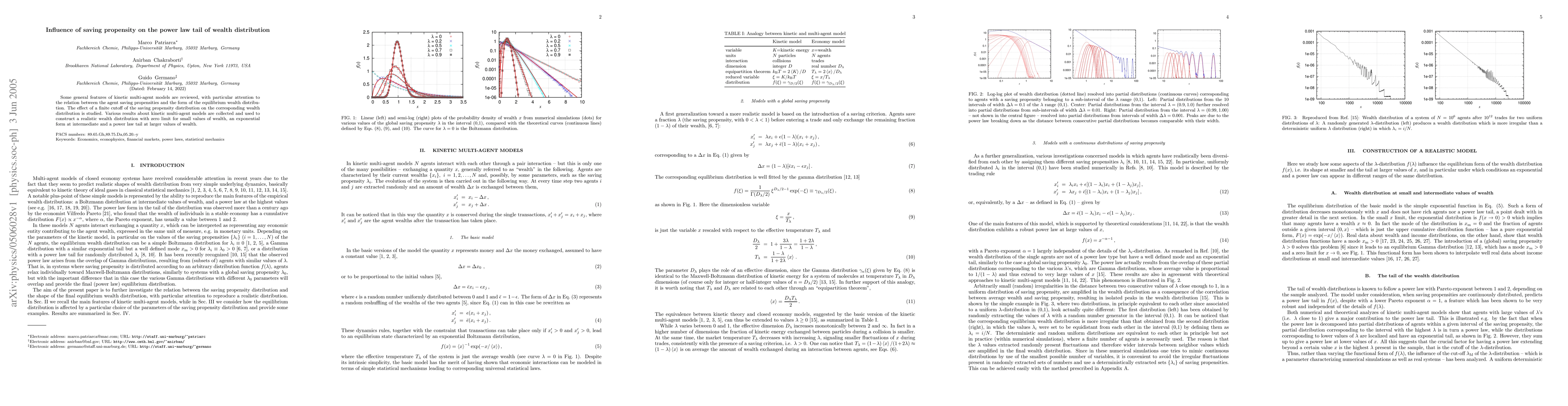

Some general features of kinetic multi-agent models are reviewed, with particular attention to the relation between the agent saving propensities and the form of the equilibrium wealth distribution. The effect of a finite cutoff of the saving propensity distribution on the corresponding wealth distribution is studied. Various results about kinetic multi-agent models are collected and used to construct a realistic wealth distribution with zero limit for small values of wealth, an exponential form at intermediate and a power law tail at larger values of wealth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)