Summary

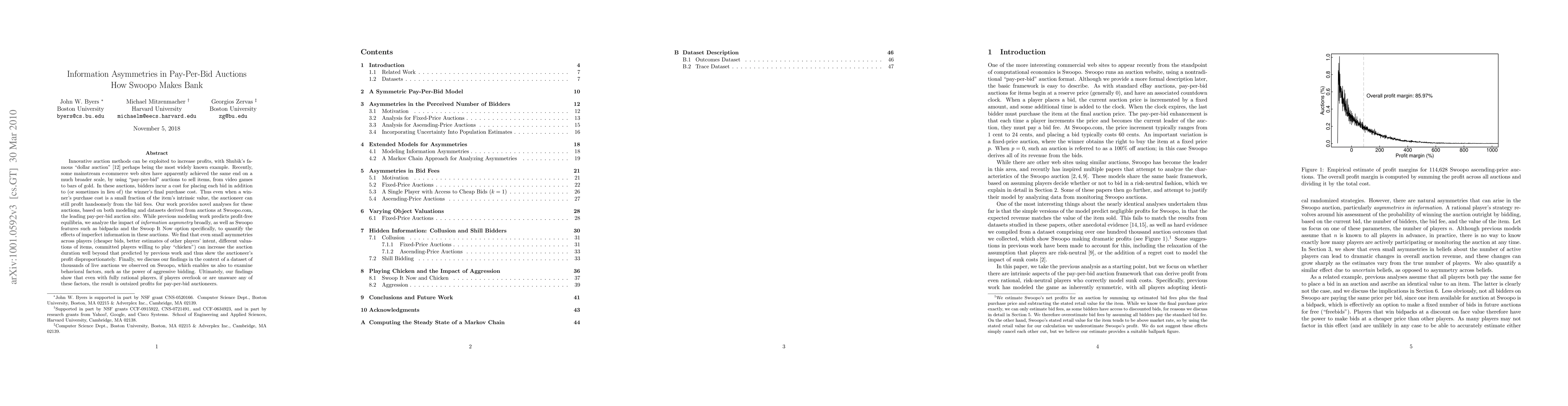

Innovative auction methods can be exploited to increase profits, with Shubik's famous "dollar auction" perhaps being the most widely known example. Recently, some mainstream e-commerce web sites have apparently achieved the same end on a much broader scale, by using "pay-per-bid" auctions to sell items, from video games to bars of gold. In these auctions, bidders incur a cost for placing each bid in addition to (or sometimes in lieu of) the winner's final purchase cost. Thus even when a winner's purchase cost is a small fraction of the item's intrinsic value, the auctioneer can still profit handsomely from the bid fees. Our work provides novel analyses for these auctions, based on both modeling and datasets derived from auctions at Swoopo.com, the leading pay-per-bid auction site. While previous modeling work predicts profit-free equilibria, we analyze the impact of information asymmetry broadly, as well as Swoopo features such as bidpacks and the Swoop It Now option specifically, to quantify the effects of imperfect information in these auctions. We find that even small asymmetries across players (cheaper bids, better estimates of other players' intent, different valuations of items, committed players willing to play "chicken") can increase the auction duration well beyond that predicted by previous work and thus skew the auctioneer's profit disproportionately. Finally, we discuss our findings in the context of a dataset of thousands of live auctions we observed on Swoopo, which enables us also to examine behavioral factors, such as the power of aggressive bidding. Ultimately, our findings show that even with fully rational players, if players overlook or are unaware any of these factors, the result is outsized profits for pay-per-bid auctioneers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning in Repeated Multi-Unit Pay-As-Bid Auctions

Negin Golrezaei, Rigel Galgana

How competitive are pay-as-bid auction games?

Giacomo Como, Fabio Fagnani, Martina Vanelli

Online Learning in Contextual Second-Price Pay-Per-Click Auctions

Haipeng Luo, Mengxiao Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)