Authors

Summary

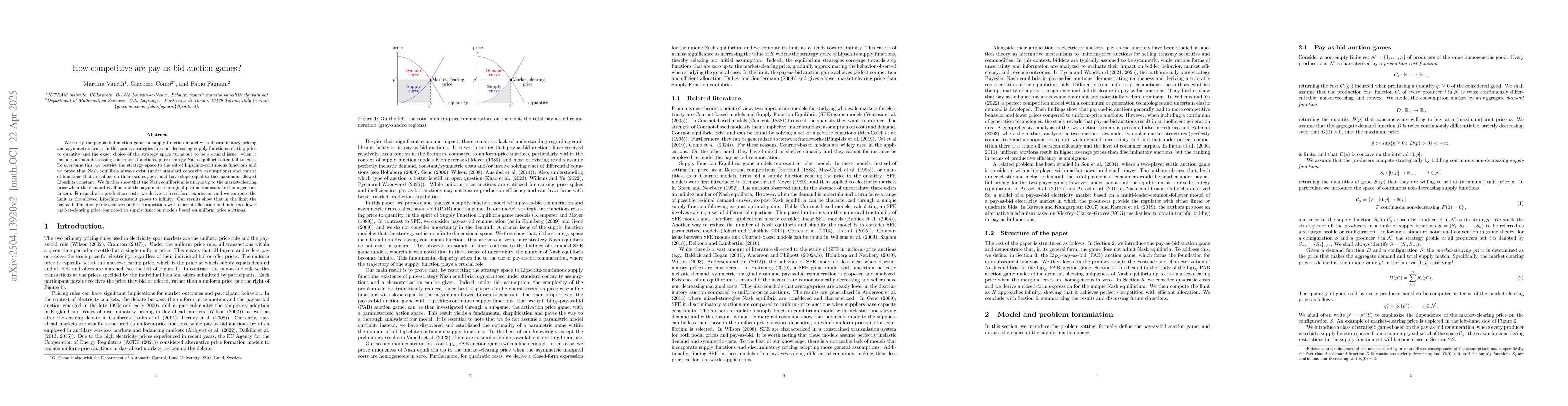

We study the pay-as-bid auction game, a supply function model with discriminatory pricing and asymmetric firms. In this game, strategies are non-decreasing supply functions relating pric to quantity and the exact choice of the strategy space turns out to be a crucial issue: when it includes all non-decreasing continuous functions, pure-strategy Nash equilibria often fail to exist. To overcome this, we restrict the strategy space to the set of Lipschitz-continuous functions and we prove that Nash equilibria always exist (under standard concavity assumptions) and consist of functions that are affine on their own support and have slope equal to the maximum allowed Lipschitz constant. We further show that the Nash equilibrium is unique up to the market-clearing price when the demand is affine and the asymmetric marginal production costs are homogeneous in zero. For quadratic production costs, we derive a closed-form expression and we compute the limit as the allowed Lipschitz constant grows to infinity. Our results show that in the limit the pay-as-bid auction game achieves perfect competition with efficient allocation and induces a lower market-clearing price compared to supply function models based on uniform price auctions.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research employs a pay-as-bid auction game model, integrating supply function strategies, pay-as-bid remuneration, and asymmetric firms. It limits the strategy space to Lipschitz-continuous supply functions to ensure the existence of pure-strategy Nash equilibria, which are characterized as piecewise affine functions with slope equal to the maximum allowed Lipschitz constant.

Key Results

- Nash equilibria always exist (under standard concavity assumptions) and consist of affine functions on their own support with slope equal to the maximum allowed Lipschitz constant.

- Unique equilibrium up to the market-clearing price when demand is affine and asymmetric marginal production costs are homogeneous in zero.

- Closed-form expression for quadratic production costs, with a limit as the allowed Lipschitz constant grows to infinity.

- In the limit, the pay-as-bid auction game achieves perfect competition with efficient allocation and induces a lower market-clearing price compared to supply function models based on uniform price auctions.

Significance

This study provides a comprehensive analysis of the pay-as-bid auction game, demonstrating that it can achieve perfect competition and efficient allocation, even with asymmetric firms and discriminatory pricing, which is significant for understanding market dynamics in various industries.

Technical Contribution

The paper introduces a novel approach to characterizing Nash equilibria in auction games by restricting the strategy space to Lipschitz-continuous functions, ensuring the existence of equilibria and providing a framework for analyzing their properties.

Novelty

The research distinguishes itself by focusing on the pay-as-bid auction game with supply function strategies and asymmetric firms, proving the existence and uniqueness of equilibria under specific conditions, and demonstrating its convergence to perfect competition in the limit as K approaches infinity.

Limitations

- The model assumes quadratic production costs and affine demand, which may limit its applicability to more complex cost structures.

- The analysis does not account for demand uncertainty, which could affect the robustness of the equilibrium outcomes.

Future Work

- Investigate the model with heterogeneous costs in zero and explore the impact on equilibrium outcomes.

- Extend the analysis to incorporate capacity constraints and network structures to better capture real-world market complexities.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNash equilibria of the pay-as-bid auction with K-Lipschitz supply functions

Giacomo Como, Fabio Fagnani, Martina Vanelli

Learning in Repeated Multi-Unit Pay-As-Bid Auctions

Negin Golrezaei, Rigel Galgana

Rethinking Pricing in Energy Markets: Pay-as-Bid vs Pay-as-Clear

Stratis Skoulakis, Ioannis Caragiannis, Zhile Jiang

No citations found for this paper.

Comments (0)