Authors

Summary

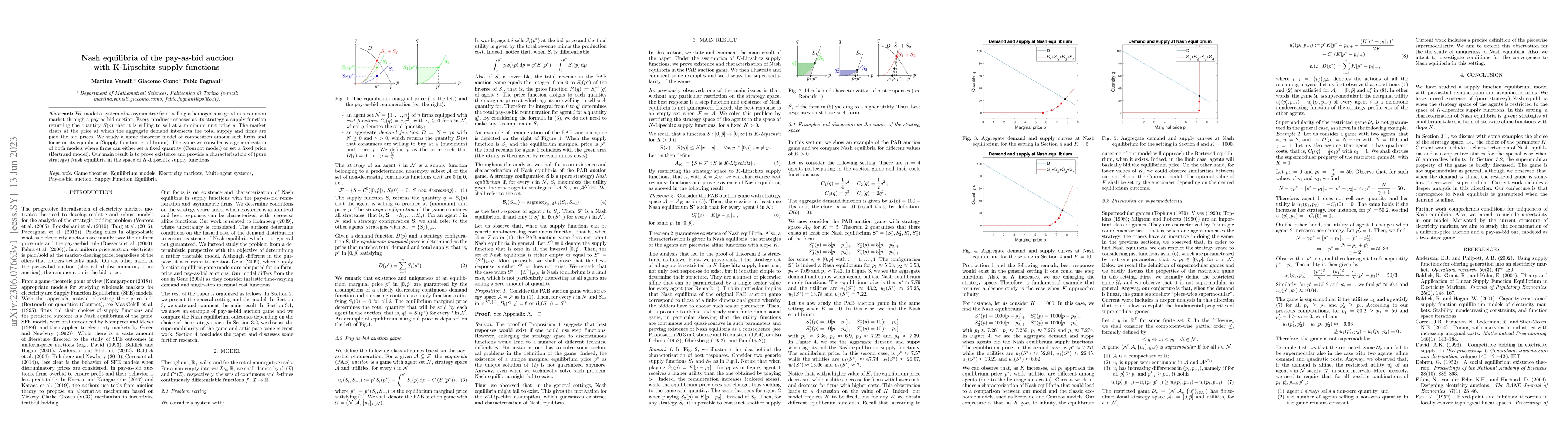

We model a system of n asymmetric firms selling a homogeneous good in a common market through a pay-as-bid auction. Every producer chooses as its strategy a supply function returning the quantity S(p) that it is willing to sell at a minimum unit price p. The market clears at the price at which the aggregate demand intersects the total supply and firms are paid the bid prices. We study a game theoretic model of competition among such firms and focus on its equilibria (Supply function equilibrium). The game we consider is a generalization of both models where firms can either set a fixed quantity (Cournot model) or set a fixed price (Bertrand model). Our main result is to prove existence and provide a characterization of (pure strategy) Nash equilibria in the space of K-Lipschitz supply functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHow competitive are pay-as-bid auction games?

Giacomo Como, Fabio Fagnani, Martina Vanelli

Discrete Two Player All-Pay Auction with Complete Information

Marcin Dziubiński, Krzysztof Jahn

Learning in Repeated Multi-Unit Pay-As-Bid Auctions

Negin Golrezaei, Rigel Galgana

Rethinking Pricing in Energy Markets: Pay-as-Bid vs Pay-as-Clear

Stratis Skoulakis, Ioannis Caragiannis, Zhile Jiang

| Title | Authors | Year | Actions |

|---|

Comments (0)