Summary

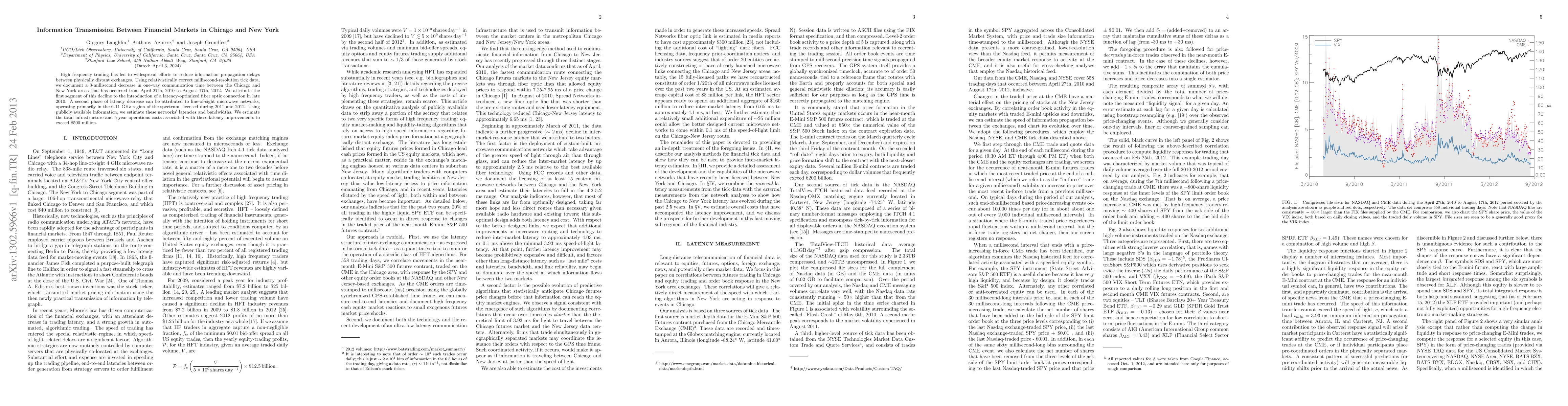

High frequency trading has led to widespread efforts to reduce information propagation delays between physically distant exchanges. Using relativistically correct millisecond-resolution tick data, we document a 3-millisecond decrease in one-way communication time between the Chicago and New York areas that has occurred from April 27th, 2010 to August 17th, 2012. We attribute the first segment of this decline to the introduction of a latency-optimized fiber optic connection in late 2010. A second phase of latency decrease can be attributed to line-of-sight microwave networks, operating primarily in the 6-11 GHz region of the spectrum, licensed during 2011 and 2012. Using publicly available information, we estimate these networks' latencies and bandwidths. We estimate the total infrastructure and 5-year operations costs associated with these latency improvements to exceed $500 million.

AI Key Findings

Generated Sep 03, 2025

Methodology

The study uses high-frequency tick data from the Chicago Mercantile Exchange (CME) and NASDAQ to analyze information propagation latency between financial markets in Chicago and New York. It employs a correlation analysis of exchange-provided tick data, along with external estimates from FCC licenses and radio equipment.

Key Results

- A 3-millisecond decrease in one-way communication time between Chicago and New York from April 27th, 2010 to August 17th, 2012 was documented.

- The latency reduction was attributed to the introduction of a latency-optimized fiber optic connection in late 2010 and line-of-sight microwave networks operating in the 6-11 GHz spectrum, licensed during 2011 and 2012.

- Estimated total infrastructure and 5-year operation costs for these latency improvements exceeded $500 million.

- The analysis revealed a steady decrease in latency, dropping from 6-7 ms in Fall 2010 to 3-4 ms by August 2012, likely due to the construction, commissioning, and adoption of microwave data transmission by numerous firms during this period.

- A significant latency drop in late January 2012 coincided with the CME's co-location move from 350 Cermak to its Aurora data center.

Significance

This research is important as it highlights the continuous efforts to reduce information propagation delays in high-frequency trading, impacting the competitiveness of trading firms and the overall efficiency of financial markets.

Technical Contribution

The paper presents a novel methodology for estimating latency improvements in financial data transmission using exchange-provided tick data and FCC license records.

Novelty

This work distinguishes itself by correlating financial tick data with external infrastructure information, providing a comprehensive view of latency reduction efforts in high-frequency trading markets.

Limitations

- The study relies on inferred properties of licensed microwave networks, as the existence of an FCC license does not guarantee a link's functionality.

- It is challenging to determine the exact latency of information transport and the number of firms using each route due to the lack of available data.

- The analysis does not account for potential future regulatory changes that could impact the development of low-latency networks.

Future Work

- Investigate the impact of emerging technologies, such as hollow-core fibers or floating microwave stations, on reducing latency further.

- Explore the potential of exotic technologies like neutrino or axion communications for ultra-fast information transfer in the distant future.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Comparison between Financial and Gambling Markets

Haoyu Liu, Carl Donovan, Valentin Popov

| Title | Authors | Year | Actions |

|---|

Comments (0)