Authors

Summary

We present a new discrete time version of Kyle's (1985) classic model of insider trading, formulated as a generalised extensive form game. The model has three kinds of traders: an insider, random noise traders, and a market maker. The insider aims to exploit her informational advantage and maximise expected profits while the market maker observes the total order flow and sets prices accordingly. First, we show how the multi-period model with finitely many pure strategies can be reduced to a (static) social system in the sense of Debreu (1952) and prove the existence of a sequential Kyle equilibrium, following Kreps and Wilson (1982). This works for any probability distribution with finite support of the noise trader's demand and the true value, and for any finite information flow of the insider. In contrast to Kyle (1985) with normal distributions, equilibria exist in general only in mixed strategies and not in pure strategies. In the single-period model we establish bounds for the insider's strategy in equilibrium. Finally, we prove the existence of an equilibrium for the game with a continuum of actions, by considering an approximating sequence of games with finitely many actions. Because of the lack of compactness of the set of measurable price functions, standard infinite-dimensional fixed point theorems are not applicable.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper presents a discrete-time version of Kyle's (1985) classic model of insider trading, formulated as a generalized extensive form game involving an insider, random noise traders, and a market maker. It reduces the multi-period model with finitely many pure strategies to a static social system, proving the existence of a sequential Kyle equilibrium for any probability distribution of noise trader's demand and true value, and finite information flow of the insider.

Key Results

- Existence of a sequential Kyle equilibrium in a static social system for any probability distribution with finite support of noise trader's demand and true value, and finite information flow of the insider.

- Equilibria exist generally only in mixed strategies, not pure strategies, contrasting with Kyle (1985) which assumed normal distributions.

- Bounds for the insider's strategy in equilibrium are established in the single-period model.

- Existence of an equilibrium for the game with a continuum of actions is proven by considering an approximating sequence of games with finitely many actions.

Significance

This research extends Kyle's model to discrete time, allowing for a broader range of distributions and providing a more flexible framework for analyzing insider trading dynamics, which is crucial for understanding market efficiency and regulatory implications.

Technical Contribution

The paper develops a novel approach to reduce a multi-period extensive form game to a static social system, enabling the proof of existence of a sequential Kyle equilibrium under broader conditions than previously assumed.

Novelty

The discrete-time formulation and the extension to generalized distributions with finite support provide a more versatile model for analyzing insider trading, contrasting with the continuous-time and normally distributed assumptions in Kyle (1985).

Limitations

- The model assumes perfect rationality and does not account for behavioral biases or market frictions.

- The focus on a simplified three-player game does not capture the complexity of real-world markets with numerous traders.

Future Work

- Investigating the impact of behavioral biases and market frictions on equilibrium outcomes.

- Expanding the model to include more realistic market structures with numerous traders.

Paper Details

PDF Preview

Key Terms

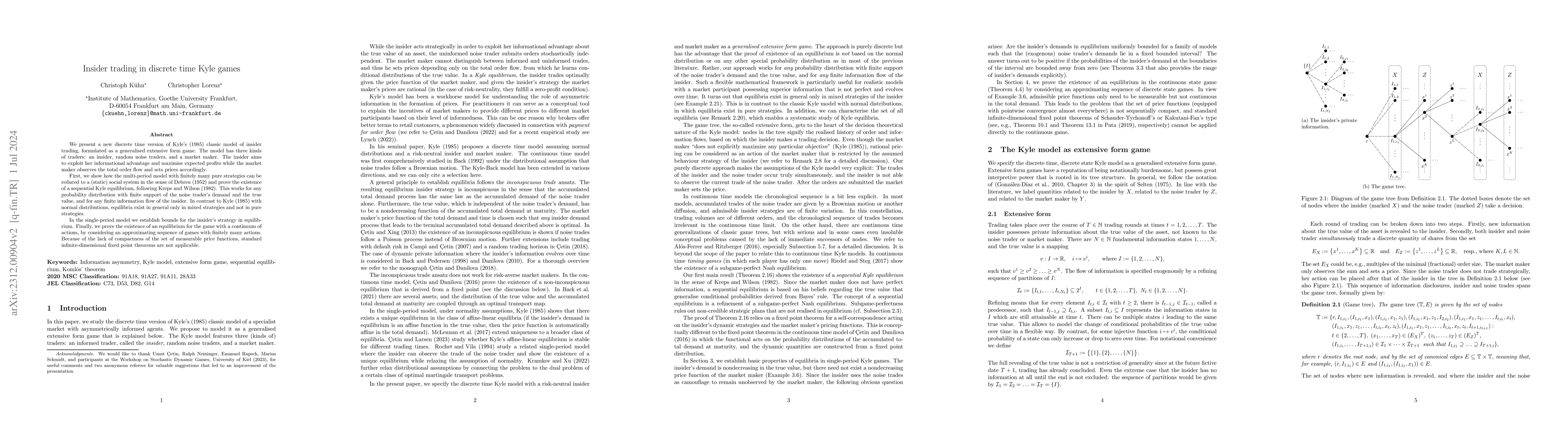

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrading constraints in continuous-time Kyle models

Kasper Larsen, Jin Hyuk Choi, Heeyoung Kwon

No citations found for this paper.

Comments (0)