Authors

Summary

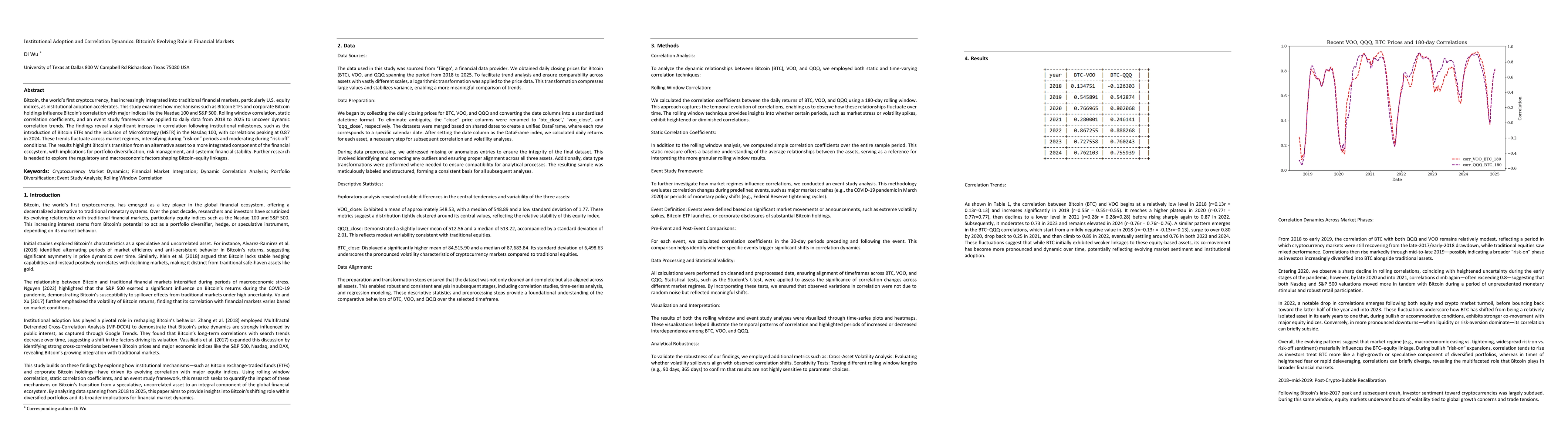

Bitcoin, widely recognized as the first cryptocurrency, has shown increasing integration with traditional financial markets, particularly major U.S. equity indices, amid accelerating institutional adoption. This study examines how Bitcoin exchange-traded funds and corporate Bitcoin holdings affect correlations with the Nasdaq 100 and the S&P 500, using rolling-window correlation, static correlation coefficients, and an event-study framework on daily data from 2018 to 2025.Correlation levels intensified following key institutional milestones, with peaks reaching 0.87 in 2024, and they vary across market regimes. These trends suggest that Bitcoin has transitioned from an alternative asset toward a more integrated financial instrument, carrying implications for portfolio diversification, risk management, and systemic stability. Future research should further investigate regulatory and macroeconomic factors shaping these evolving relationships.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)