Summary

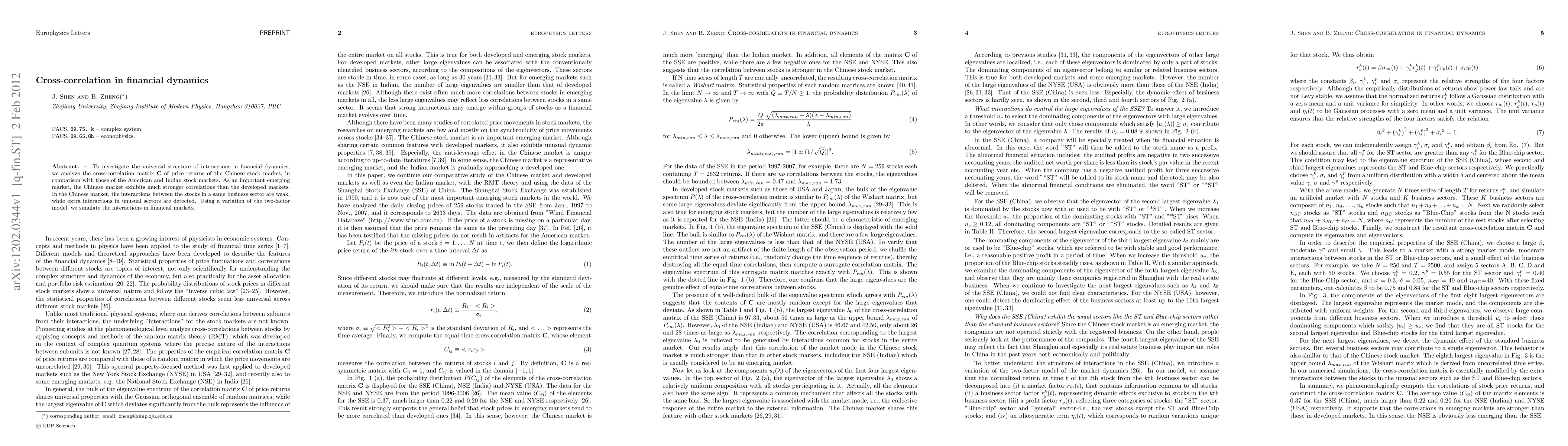

To investigate the universal structure of interactions in financial dynamics, we analyze the cross-correlation matrix C of price returns of the Chinese stock market, in comparison with those of the American and Indian stock markets. As an important emerging market, the Chinese market exhibits much stronger correlations than the developed markets. In the Chinese market, the interactions between the stocks in a same business sector are weak, while extra interactions in unusual sectors are detected. Using a variation of the two-factor model, we simulate the interactions in financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)