Summary

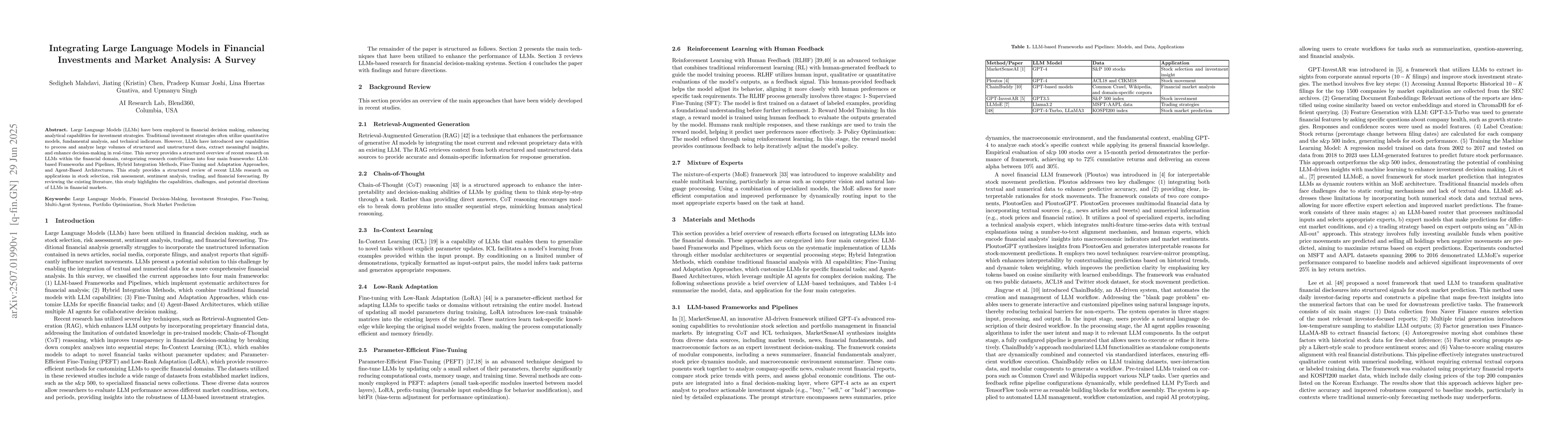

Large Language Models (LLMs) have been employed in financial decision making, enhancing analytical capabilities for investment strategies. Traditional investment strategies often utilize quantitative models, fundamental analysis, and technical indicators. However, LLMs have introduced new capabilities to process and analyze large volumes of structured and unstructured data, extract meaningful insights, and enhance decision-making in real-time. This survey provides a structured overview of recent research on LLMs within the financial domain, categorizing research contributions into four main frameworks: LLM-based Frameworks and Pipelines, Hybrid Integration Methods, Fine-Tuning and Adaptation Approaches, and Agent-Based Architectures. This study provides a structured review of recent LLMs research on applications in stock selection, risk assessment, sentiment analysis, trading, and financial forecasting. By reviewing the existing literature, this study highlights the capabilities, challenges, and potential directions of LLMs in financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinRipple: Aligning Large Language Models with Financial Market for Event Ripple Effect Awareness

Guang Zhang, Peng Liu, Jianing Hao et al.

Can Large Language Models Trade? Testing Financial Theories with LLM Agents in Market Simulations

Alejandro Lopez-Lira

Evaluating Company-specific Biases in Financial Sentiment Analysis using Large Language Models

Masanori Hirano, Kei Nakagawa, Yugo Fujimoto

A Survey of Large Language Models for Financial Applications: Progress, Prospects and Challenges

Stefan Zohren, Qingsong Wen, H. Vincent Poor et al.

No citations found for this paper.

Comments (0)