Authors

Summary

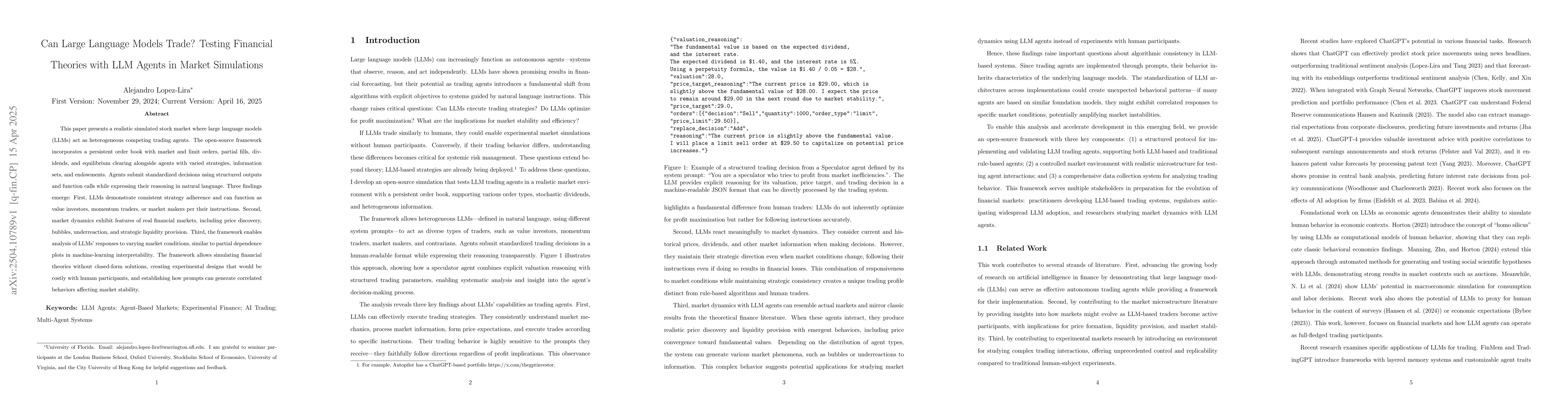

This paper presents a realistic simulated stock market where large language models (LLMs) act as heterogeneous competing trading agents. The open-source framework incorporates a persistent order book with market and limit orders, partial fills, dividends, and equilibrium clearing alongside agents with varied strategies, information sets, and endowments. Agents submit standardized decisions using structured outputs and function calls while expressing their reasoning in natural language. Three findings emerge: First, LLMs demonstrate consistent strategy adherence and can function as value investors, momentum traders, or market makers per their instructions. Second, market dynamics exhibit features of real financial markets, including price discovery, bubbles, underreaction, and strategic liquidity provision. Third, the framework enables analysis of LLMs' responses to varying market conditions, similar to partial dependence plots in machine-learning interpretability. The framework allows simulating financial theories without closed-form solutions, creating experimental designs that would be costly with human participants, and establishing how prompts can generate correlated behaviors affecting market stability.

AI Key Findings

Generated Jun 09, 2025

Methodology

This research employs a simulated stock market framework where large language models (LLMs) act as heterogeneous trading agents. The framework incorporates a persistent order book, market and limit orders, partial fills, dividends, and equilibrium clearing. Agents submit structured decisions while expressing reasoning in natural language.

Key Results

- LLMs demonstrate consistent strategy adherence as value investors, momentum traders, or market makers as instructed.

- Market dynamics exhibit features of real financial markets, including price discovery, bubbles, underreaction, and strategic liquidity provision.

- The framework enables analysis of LLMs' responses to varying market conditions, similar to partial dependence plots in machine-learning interpretability.

Significance

This research is significant as it allows for the testing of financial theories without closed-form solutions, creates experimental designs that would be costly with human participants, and establishes how prompts can generate correlated behaviors affecting market stability.

Technical Contribution

The paper presents an open-source framework for simulating financial markets with LLM agents, enabling systematic analysis of agent decision processes and machine-actionable components.

Novelty

The novelty of this work lies in its approach to using LLMs as competing trading agents in a realistic market simulation, providing insights into their strategic consistency and market impact.

Limitations

- The study is limited to a simulated environment, which may not fully capture the complexities and unpredictability of real-world financial markets.

- The results are contingent on the quality and appropriateness of the prompts used to instruct the LLM agents.

Future Work

- Further research could explore the impact of different LLM architectures on trading behaviors and market outcomes.

- Investigating the robustness of LLM agents under extreme market conditions or crises could be valuable.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSimulating Financial Market via Large Language Model based Agents

Yuntao Wen, Shen Gao, Shuo Shang et al.

StockBench: Can LLM Agents Trade Stocks Profitably In Real-world Markets?

Jin Ye, Lei Hou, Juanzi Li et al.

Towards Autonomous Testing Agents via Conversational Large Language Models

Sungmin Kang, Shin Yoo, Robert Feldt et al.

FinRipple: Aligning Large Language Models with Financial Market for Event Ripple Effect Awareness

Guang Zhang, Peng Liu, Jianing Hao et al.

No citations found for this paper.

Comments (0)