Summary

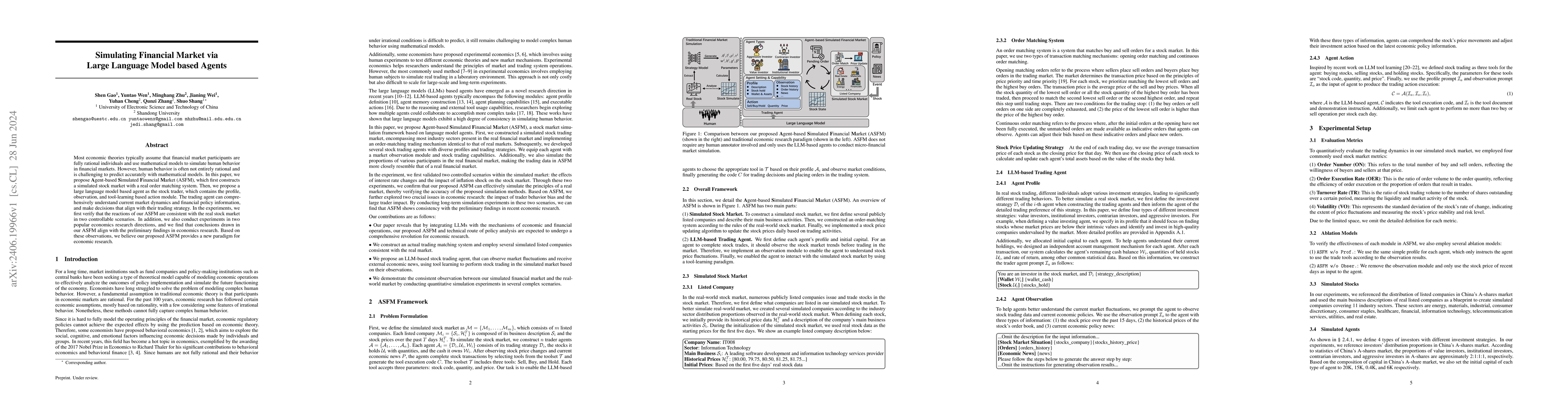

Most economic theories typically assume that financial market participants are fully rational individuals and use mathematical models to simulate human behavior in financial markets. However, human behavior is often not entirely rational and is challenging to predict accurately with mathematical models. In this paper, we propose \textbf{A}gent-based \textbf{S}imulated \textbf{F}inancial \textbf{M}arket (ASFM), which first constructs a simulated stock market with a real order matching system. Then, we propose a large language model based agent as the stock trader, which contains the profile, observation, and tool-learning based action module. The trading agent can comprehensively understand current market dynamics and financial policy information, and make decisions that align with their trading strategy. In the experiments, we first verify that the reactions of our ASFM are consistent with the real stock market in two controllable scenarios. In addition, we also conduct experiments in two popular economics research directions, and we find that conclusions drawn in our \model align with the preliminary findings in economics research. Based on these observations, we believe our proposed ASFM provides a new paradigm for economic research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCan Large Language Models Trade? Testing Financial Theories with LLM Agents in Market Simulations

Alejandro Lopez-Lira

EconAgent: Large Language Model-Empowered Agents for Simulating Macroeconomic Activities

Qingmin Liao, Yong Li, Chen Gao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)