Authors

Summary

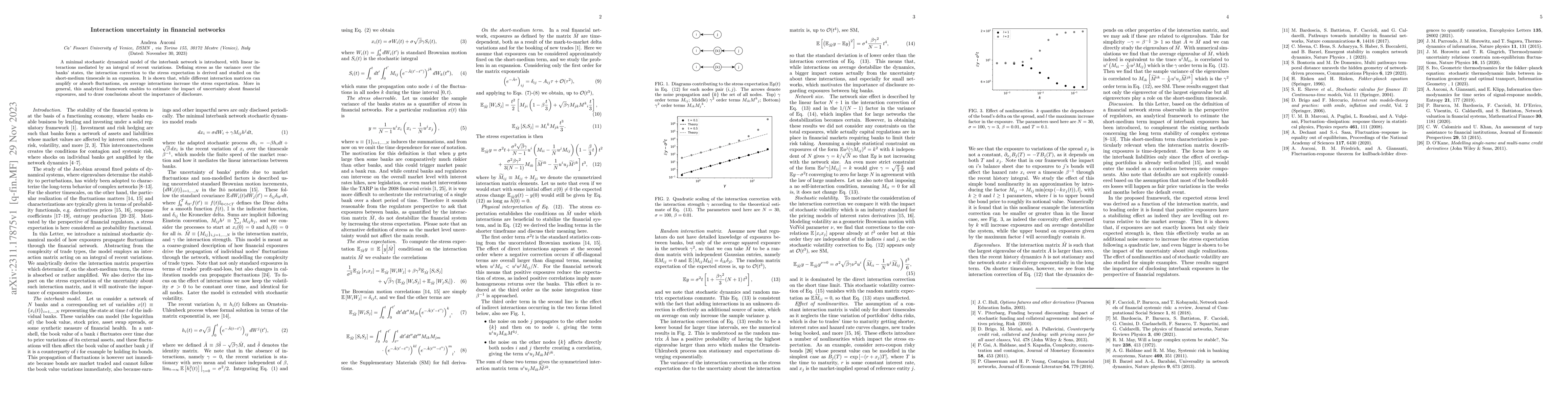

A minimal stochastic dynamical model of the interbank network is introduced, with linear interactions mediated by an integral of recent variations. Defining stress as the variance over the banks' states, the interaction correction to the stress expectation is derived and studied on the short-medium timescale in an expansion. It is shown that, while different interaction matrices can amplify or absorb fluctuations, on average interactions increase the stress expectation. More in general, this analytical framework enables to estimate the impact of uncertainty about financial exposures, and to draw conclusions about the importance of disclosure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUncertainty in the financial market and application to forecastabnormal financial fluctuations

Wenqing Zhang, Shige Peng, Shuzhen Yang

No citations found for this paper.

Comments (0)