Summary

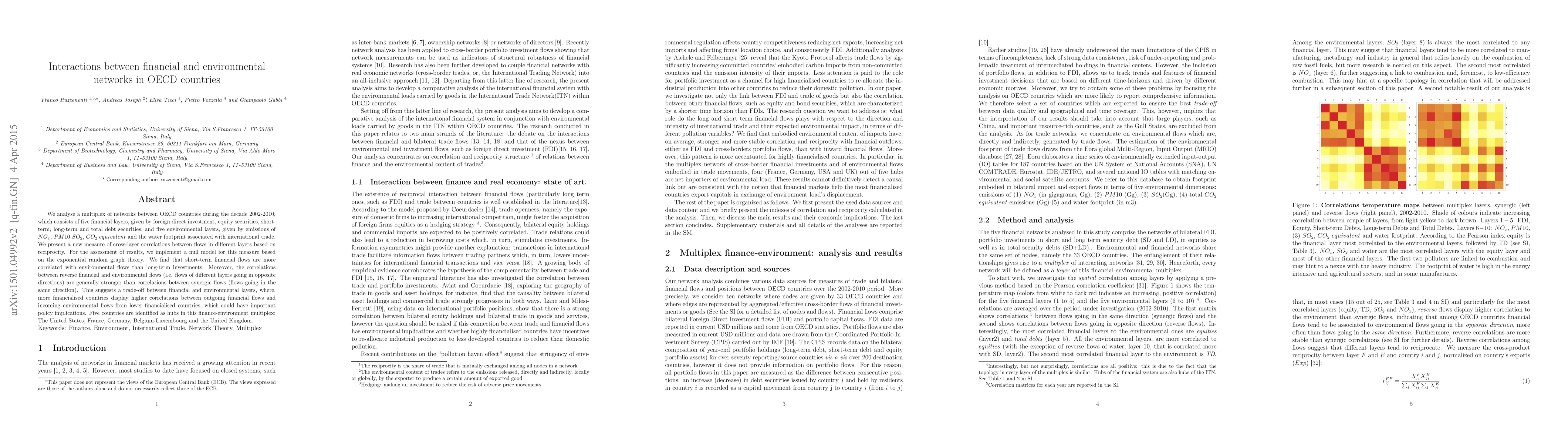

We analyse a multiplex of networks between OECD countries during the decade 2002-2010, which consists of five financial layers, given by foreign direct investment, equity securities, short-term, long-term and total debt securities, and five environmental layers, given by emissions of N O x, P M 10 SO 2, CO 2 equivalent and the water footprint associated with international trade. We present a new measure of cross-layer correlations between flows in different layers based on reciprocity. For the assessment of results, we implement a null model for this measure based on the exponential random graph theory. We find that short-term financial flows are more correlated with environmental flows than long-term investments. Moreover, the correlations between reverse financial and environmental flows (i.e. flows of different layers going in opposite directions) are generally stronger than correlations between synergic flows (flows going in the same direction). This suggests a trade-off between financial and environmental layers, where, more financialised countries display higher correlations between outgoing financial flows and incoming environmental flows from lower financialised countries, which could have important policy implications. Five countries are identified as hubs in this finance-environment multiplex: The United States, France, Germany, Belgium-Luxembourg and the United Kingdom.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)