Summary

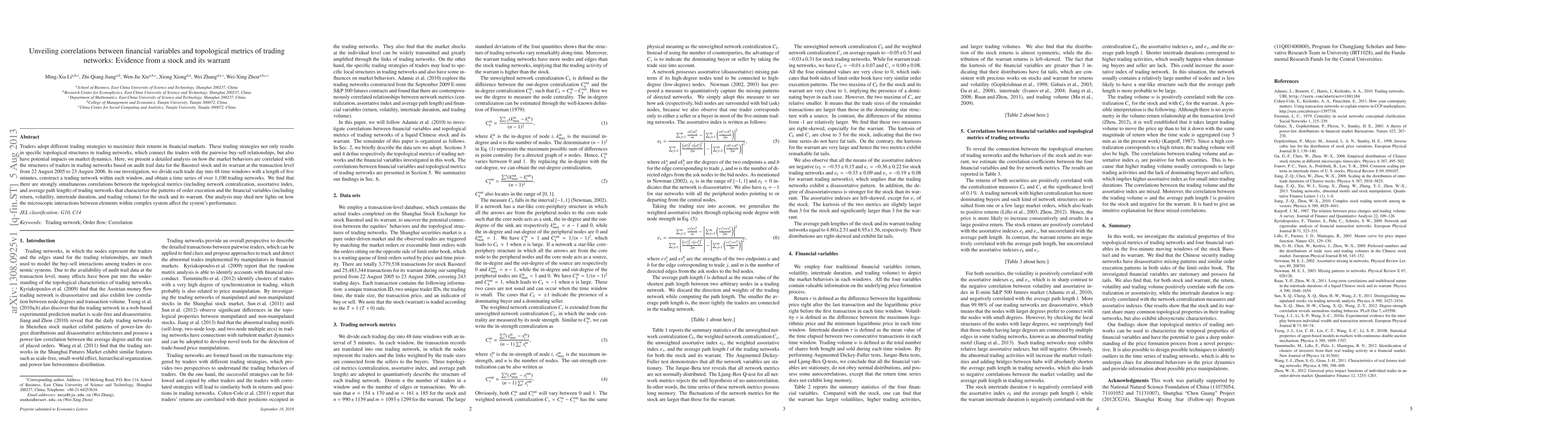

Traders adopt different trading strategies to maximize their returns in financial markets. These trading strategies not only results in specific topological structures in trading networks, which connect the traders with the pairwise buy-sell relationships, but also have potential impacts on market dynamics. Here, we present a detailed analysis on how the market behaviors are correlated with the structures of traders in trading networks based on audit trail data for the Baosteel stock and its warrant at the transaction level from 22 August 2005 to 23 August 2006. In our investigation, we divide each trade day into 48 time windows with a length of five minutes, construct a trading network within each window, and obtain a time series of over 1,100 trading networks. We find that there are strongly simultaneous correlations between the topological metrics (including network centralization, assortative index, and average path length) of trading networks that characterize the patterns of order execution and the financial variables (including return, volatility, intertrade duration, and trading volume) for the stock and its warrant. Our analysis may shed new lights on how the microscopic interactions between elements within complex system affect the system's performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)