Summary

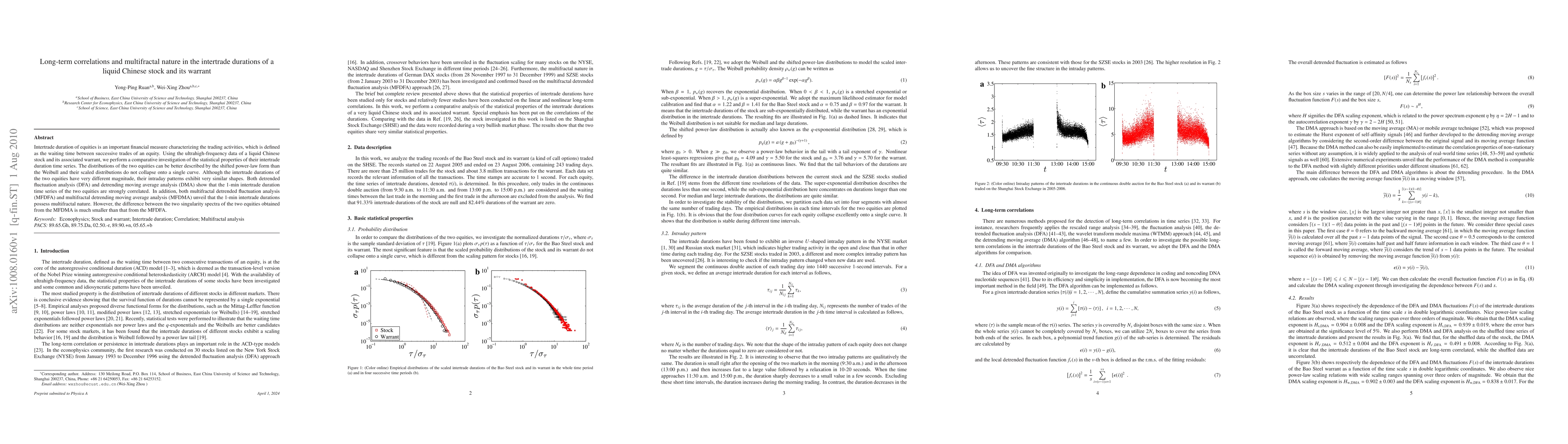

Intertrade duration of equities is an important financial measure characterizing the trading activities, which is defined as the waiting time between successive trades of an equity. Using the ultrahigh-frequency data of a liquid Chinese stock and its associated warrant, we perform a comparative investigation of the statistical properties of their intertrade duration time series. The distributions of the two equities can be better described by the shifted power-law form than the Weibull and their scaled distributions do not collapse onto a single curve. Although the intertrade durations of the two equities have very different magnitude, their intraday patterns exhibit very similar shapes. Both detrended fluctuation analysis (DFA) and detrending moving average analysis (DMA) show that the 1-min intertrade duration time series of the two equities are strongly correlated. In addition, both multifractal detrended fluctuation analysis (MFDFA) and multifractal detrending moving average analysis (MFDMA) unveil that the 1-min intertrade durations possess multifractal nature. However, the difference between the two singularity spectra of the two equities obtained from the MFDMA is much smaller than that from the MFDFA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)