Authors

Summary

This paper describes multi-portfolio `internal' rebalancing processes used in the finance industry. Instead of trading with the market to `externally' rebalance, these internal processes detail how portfolio managers buy and sell between their portfolios to rebalance. We give an overview of currently used internal rebalancing processes, including one known as the `banker' process and another known as the `linear' process. We prove the banker process disadvantages the nominated banker portfolio in volatile markets, while the linear process may advantage or disadvantage portfolios. We describe an alternative process that uses the concept of `market-invariance'. We give analytic solutions for small cases, while in general show that the $n$-portfolio solution and its corresponding `market-invariant' algorithm solve a system of nonlinear polynomial equations. It turns out this algorithm is a rediscovery of the RAS algorithm (also called the `iterative proportional fitting procedure') for biproportional matrices. We show that this process is more equitable than the banker and linear processes, and demonstrate this with empirical results. The market-invariant process has already been implemented by industry due to the significance of these results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

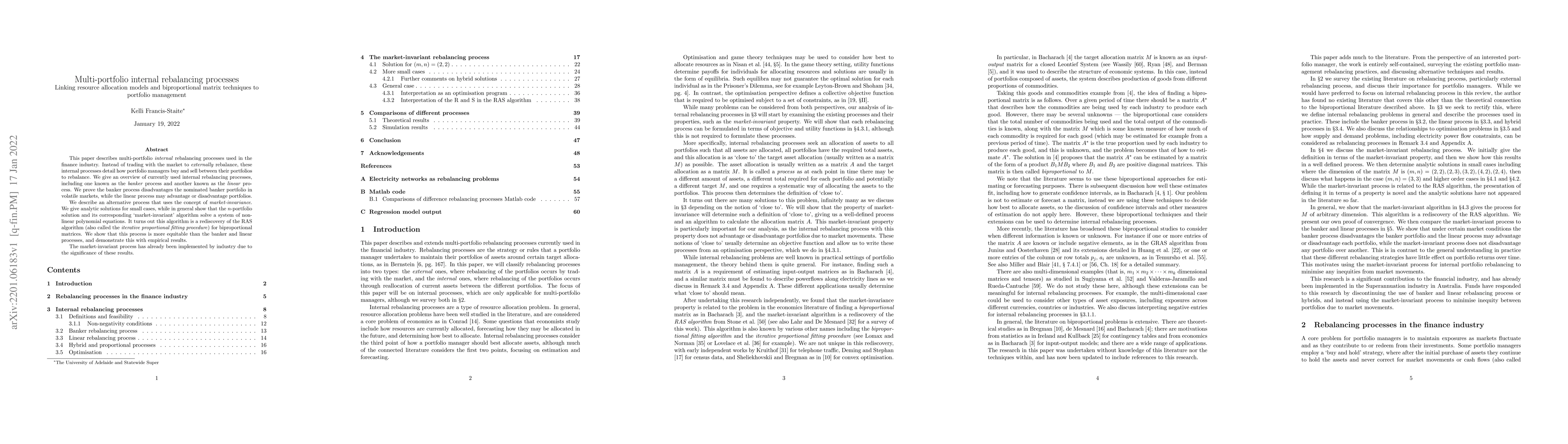

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)