Summary

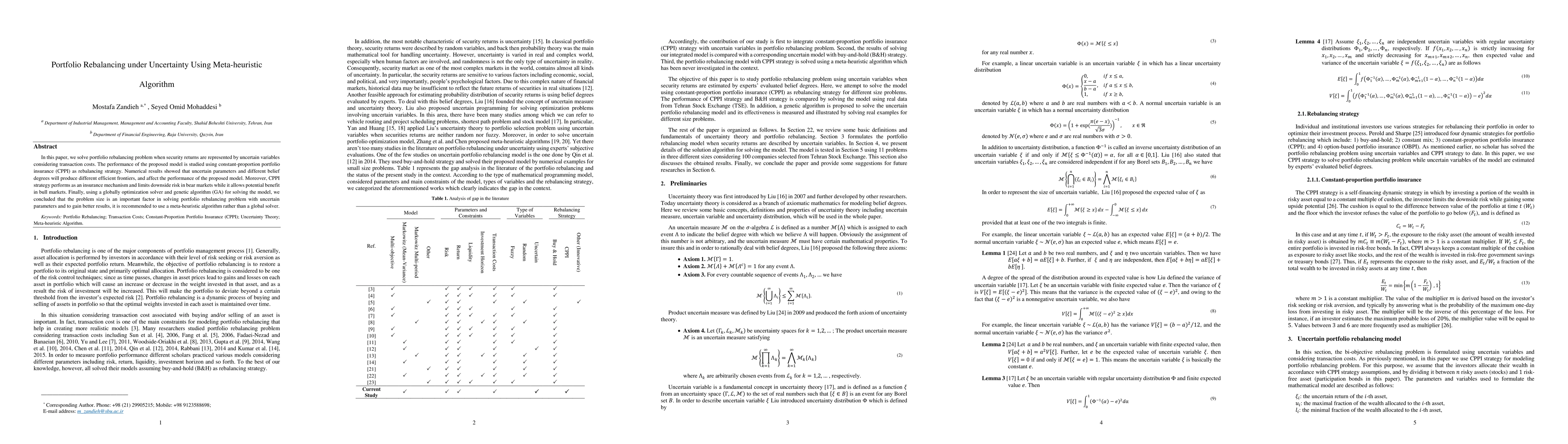

In this paper, we solve portfolio rebalancing problem when security returns are represented by uncertain variables considering transaction costs. The performance of the proposed model is studied using constant-proportion portfolio insurance (CPPI) as rebalancing strategy. Numerical results showed that uncertain parameters and different belief degrees will produce different efficient frontiers, and affect the performance of the proposed model. Moreover, CPPI strategy performs as an insurance mechanism and limits downside risk in bear markets while it allows potential benefit in bull markets. Finally, using a globally optimization solver and genetic algorithm (GA) for solving the model, we concluded that the problem size is an important factor in solving portfolio rebalancing problem with uncertain parameters and to gain better results, it is recommended to use a meta-heuristic algorithm rather than a global solver.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVehicle Rebalancing Under Adherence Uncertainty

Gioele Zardini, Rong Su, Avalpreet Singh Brar

| Title | Authors | Year | Actions |

|---|

Comments (0)