Summary

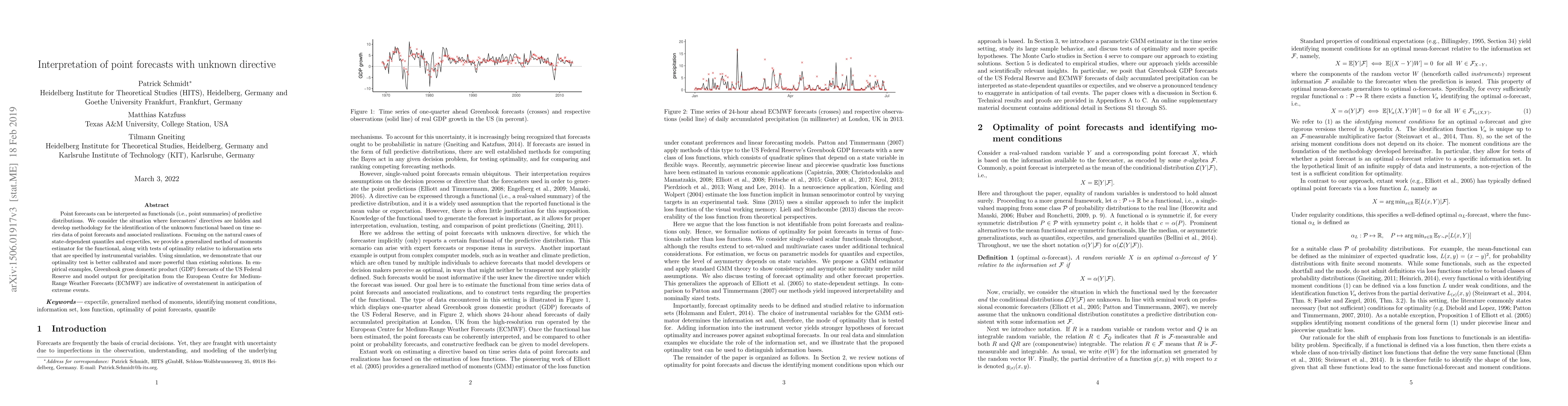

Point forecasts can be interpreted as functionals (i.e., point summaries) of predictive distributions. We consider the situation where forecasters' directives are hidden and develop methodology for the identification of the unknown functional based on time series data of point forecasts and associated realizations. Focusing on the natural cases of state-dependent quantiles and expectiles, we provide a generalized method of moments estimator for the functional, along with tests of optimality relative to information sets that are specified by instrumental variables. Using simulation, we demonstrate that our optimality test is better calibrated and more powerful than existing solutions. In empirical examples, Greenbook gross domestic product (GDP) forecasts of the US Federal Reserve and model output for precipitation from the European Centre for Medium-Range Weather Forecasts (ECMWF) are indicative of overstatement in anticipation of extreme events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparative evaluation of point process forecasts

Tilmann Gneiting, Marcus Herrmann, Warner Marzocchi et al.

Measurability of functionals and of ideal point forecasts

Hajo Holzmann, Tobias Fissler

Dual Interpretation of Machine Learning Forecasts

Philippe Goulet Coulombe, Karin Klieber, Maximilian Goebel

| Title | Authors | Year | Actions |

|---|

Comments (0)