Summary

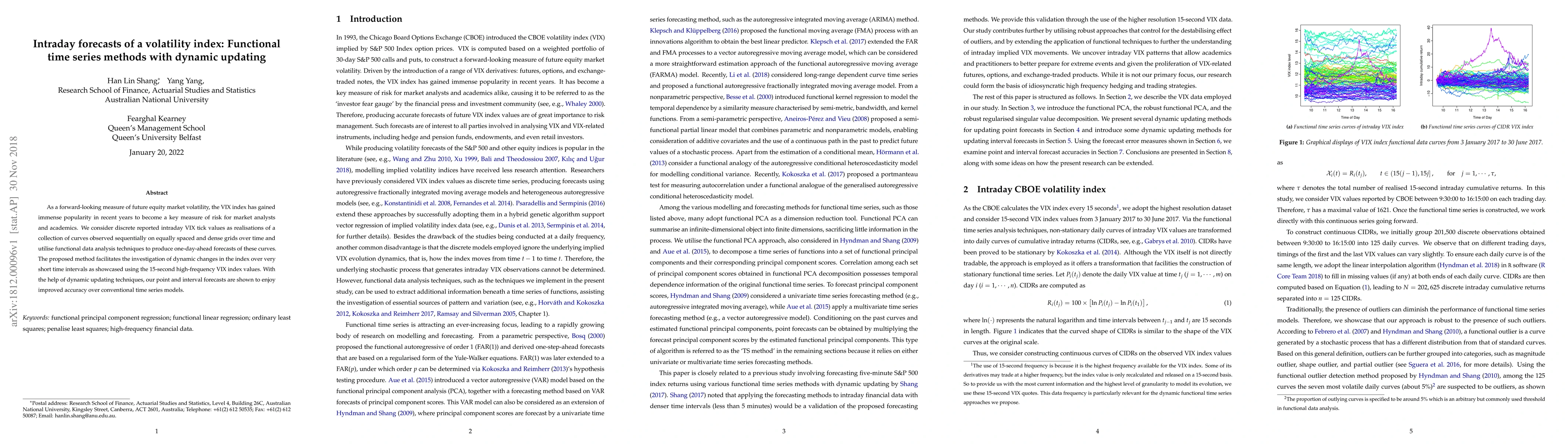

As a forward-looking measure of future equity market volatility, the VIX index has gained immense popularity in recent years to become a key measure of risk for market analysts and academics. We consider discrete reported intraday VIX tick values as realisations of a collection of curves observed sequentially on equally spaced and dense grids over time and utilise functional data analysis techniques to produce one-day-ahead forecasts of these curves. The proposed method facilitates the investigation of dynamic changes in the index over very short time intervals as showcased using the 15-second high-frequency VIX index values. With the help of dynamic updating techniques, our point and interval forecasts are shown to enjoy improved accuracy over conventional time series models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting intraday financial time series with sieve bootstrapping and dynamic updating

Han Lin Shang, Kaiying Ji

Forecasting intraday particle number size distribution: A functional time series approach

Han Lin Shang, Israel Martinez Hernandez

| Title | Authors | Year | Actions |

|---|

Comments (0)