Authors

Summary

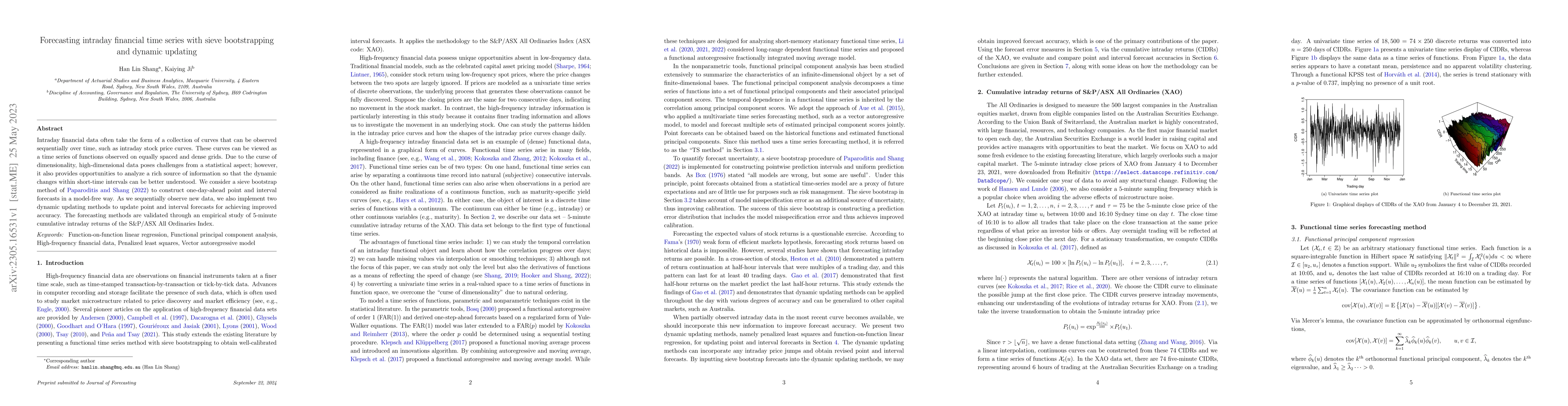

Intraday financial data often take the form of a collection of curves that can be observed sequentially over time, such as intraday stock price curves. These curves can be viewed as a time series of functions observed on equally spaced and dense grids. Due to the curse of dimensionality, high-dimensional data poses challenges from a statistical aspect; however, it also provides opportunities to analyze a rich source of information so that the dynamic changes within short-time intervals can be better understood. We consider a sieve bootstrap method of Paparoditis and Shang (2022) to construct one-day-ahead point and interval forecasts in a model-free way. As we sequentially observe new data, we also implement two dynamic updating methods to update point and interval forecasts for achieving improved accuracy. The forecasting methods are validated through an empirical study of 5-minute cumulative intraday returns of the S&P/ASX All Ordinaries Index.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic dependence networks: Financial time series forecasting and portfolio decisions (with discussion)

Mike West, Meng Xie, Zoey Yi Zhao

Financial Time Series Forecasting using CNN and Transformer

Manuela Veloso, Tucker Balch, Rachneet Kaur et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)