Authors

Summary

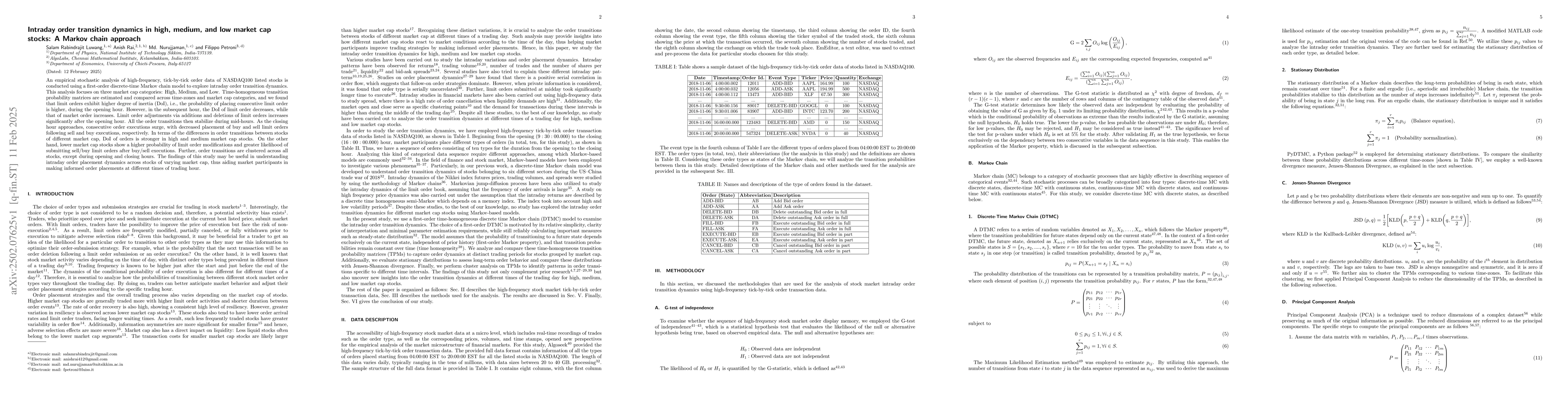

An empirical stochastic analysis of high-frequency, tick-by-tick order data of NASDAQ100 listed stocks is conducted using a first-order discrete-time Markov chain model to explore intraday order transition dynamics. This analysis focuses on three market cap categories: High, Medium, and Low. Time-homogeneous transition probability matrices are estimated and compared across time-zones and market cap categories, and we found that limit orders exhibit higher degree of inertia (DoI), i.e., the probability of placing consecutive limit order is higher, during the opening hour. However, in the subsequent hour, the DoI of limit order decreases, while that of market order increases. Limit order adjustments via additions and deletions of limit orders increases significantly after the opening hour. All the order transitions then stabilize during mid-hours. As the closing hour approaches, consecutive order executions surge, with decreased placement of buy and sell limit orders following sell and buy executions, respectively. In terms of the differences in order transitions between stocks of different market cap, DoI of orders is stronger in high and medium market cap stocks. On the other hand, lower market cap stocks show a higher probability of limit order modifications and greater likelihood of submitting sell/buy limit orders after buy/sell executions. Further, order transitions are clustered across all stocks, except during opening and closing hours. The findings of this study may be useful in understanding intraday order placement dynamics across stocks of varying market cap, thus aiding market participants in making informed order placements at different times of trading hour.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research employs a first-order discrete-time Markov chain model to analyze high-frequency, tick-by-tick order data of NASDAQ100 listed stocks, focusing on three market cap categories: High, Medium, and Low. Time-homogeneous transition probability matrices are estimated and compared across time-zones and market cap categories.

Key Results

- Limit orders exhibit higher degree of inertia (DoI) during the opening hour, but this decreases in the subsequent hour while market order DoI increases.

- Significant increase in limit order adjustments (additions and deletions) after the opening hour.

- Order transitions stabilize during mid-hours and surge as the closing hour approaches with decreased placement of buy and sell limit orders following executions.

- Higher DoI of orders in High and Medium market cap stocks compared to Low market cap stocks.

- Lower market cap stocks show greater likelihood of limit order modifications and submission of sell/buy limit orders after buy/sell executions.

Significance

This study contributes to understanding intraday order placement dynamics across stocks of varying market cap, aiding market participants in making informed order placements at different times of trading.

Technical Contribution

Application of a Markov chain model to high-frequency order data for intraday analysis of order transitions across different market cap categories.

Novelty

This research distinguishes itself by focusing on intraday order transition dynamics across high, medium, and low market cap stocks, providing insights into varying order behavior patterns.

Limitations

- The study is limited to NASDAQ100 listed stocks, so findings may not generalize to other markets or asset classes.

- Analysis does not consider external factors (e.g., news events, macroeconomic indicators) that could influence order transitions.

Future Work

- Investigate the impact of external factors on order transition dynamics.

- Extend the analysis to other markets and asset classes to assess generalizability of findings.

Paper Details

PDF Preview

Similar Papers

Found 4 papersHigh-Frequency Stock Market Order Transitions during the US-China Trade War 2018: A Discrete-Time Markov Chain Analysis

Om Prakash, Chittaranjan Hens, Anish Rai et al.

Modeling and Forecasting Intraday Market Returns: a Machine Learning Approach

Marcelo C. Medeiros, Iuri H. Ferreira

No citations found for this paper.

Comments (0)