Md. Nurujjaman

6 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

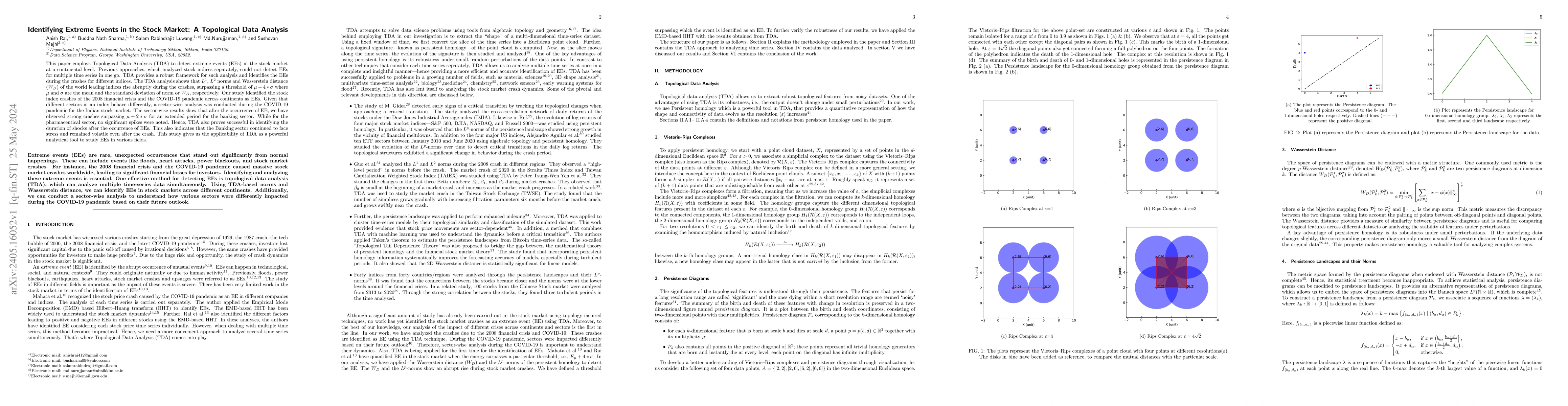

Identifying Extreme Events in the Stock Market: A Topological Data Analysis

This paper employs Topological Data Analysis (TDA) to detect extreme events (EEs) in the stock market at a continental level. Previous approaches, which analyzed stock indices separately, could not ...

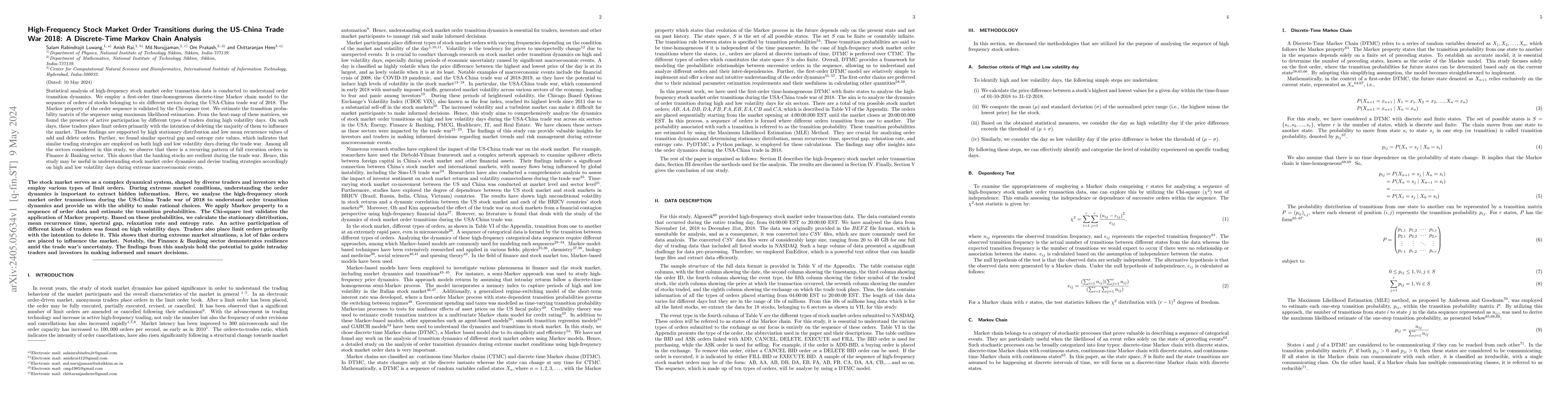

High-Frequency Stock Market Order Transitions during the US-China Trade War 2018: A Discrete-Time Markov Chain Analysis

Statistical analysis of high-frequency stock market order transaction data is conducted to understand order transition dynamics. We employ a first-order time-homogeneous discrete-time Markov chain m...

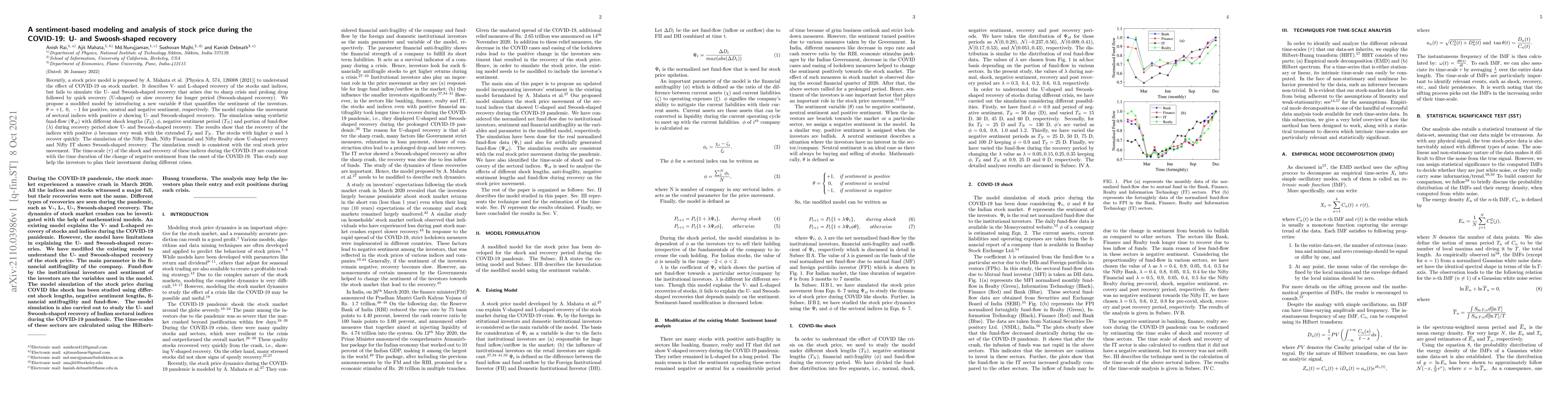

A sentiment-based modeling and analysis of stock price during the COVID-19: U- and Swoosh-shaped recovery

Recently, a stock price model is proposed by A. Mahata et al. [Physica A, 574, 126008 (2021)] to understand the effect of COVID-19 on stock market. It describes V- and L-shaped recovery of the stock...

Causality Analysis of COVID-19 Induced Crashes in Stock and Commodity Markets: A Topological Perspective

The paper presents a comprehensive causality analysis of the US stock and commodity markets during the COVID-19 crash. The dynamics of different sectors are also compared. We use Topological Data Anal...

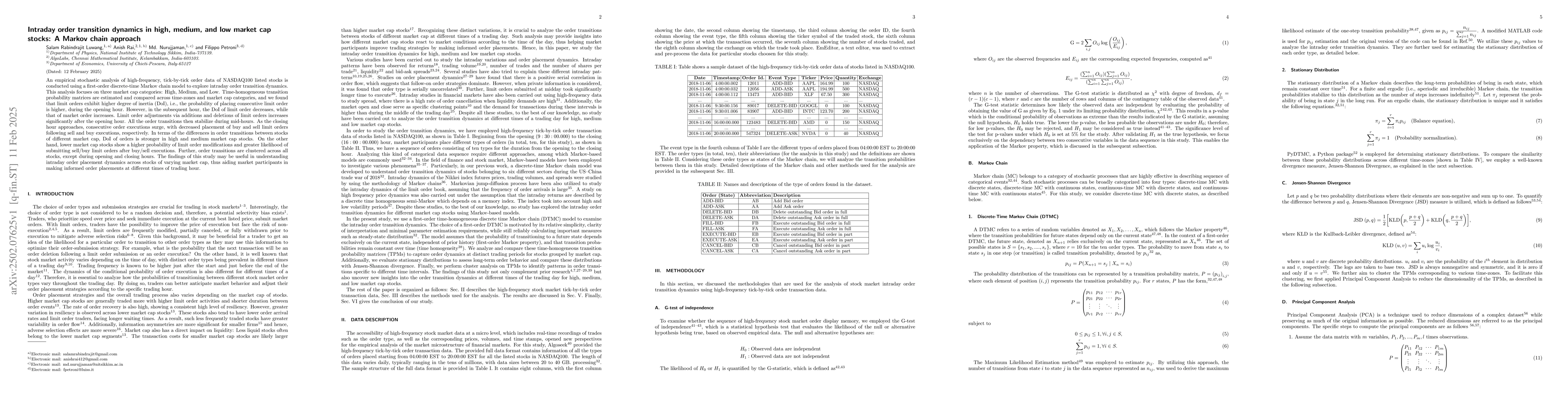

Intraday order transition dynamics in high, medium, and low market cap stocks: A Markov chain approach

An empirical stochastic analysis of high-frequency, tick-by-tick order data of NASDAQ100 listed stocks is conducted using a first-order discrete-time Markov chain model to explore intraday order trans...

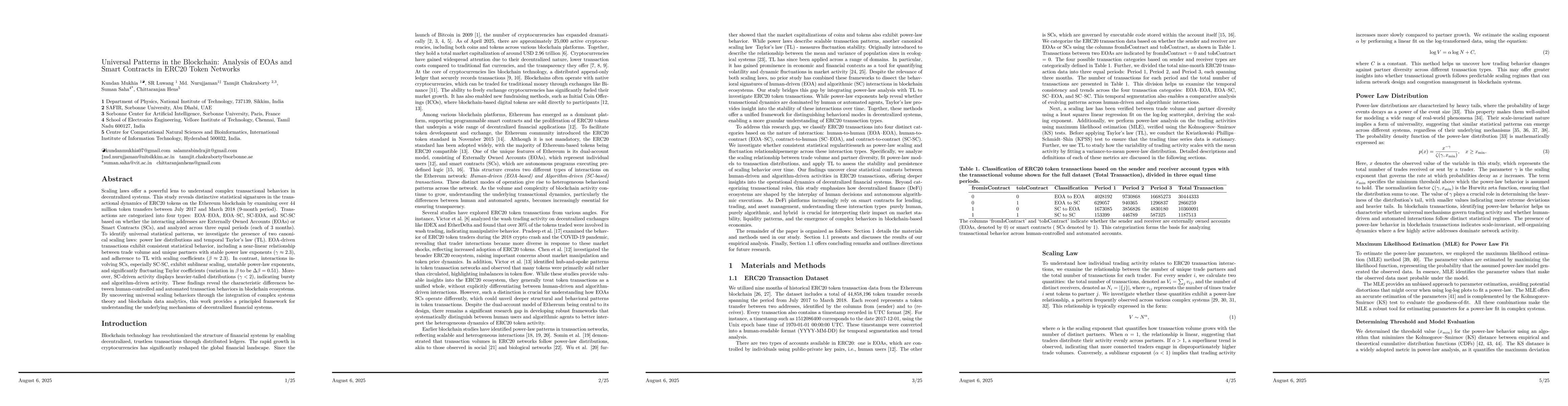

Universal Patterns in the Blockchain: Analysis of EOAs and Smart Contracts in ERC20 Token Networks

Scaling laws offer a powerful lens to understand complex transactional behaviors in decentralized systems. This study reveals distinctive statistical signatures in the transactional dynamics of ERC20 ...