Summary

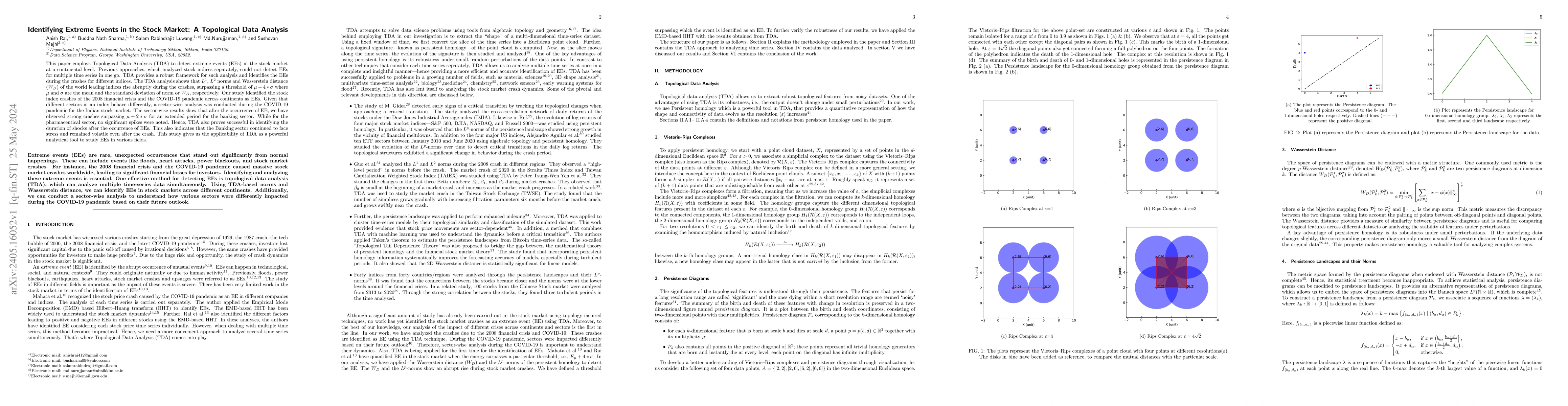

This paper employs Topological Data Analysis (TDA) to detect extreme events (EEs) in the stock market at a continental level. Previous approaches, which analyzed stock indices separately, could not detect EEs for multiple time series in one go. TDA provides a robust framework for such analysis and identifies the EEs during the crashes for different indices. The TDA analysis shows that $L^1$, $L^2$ norms and Wasserstein distance ($W_D$) of the world leading indices rise abruptly during the crashes, surpassing a threshold of $\mu+4*\sigma$ where $\mu$ and $\sigma$ are the mean and the standard deviation of norm or $W_D$, respectively. Our study identified the stock index crashes of the 2008 financial crisis and the COVID-19 pandemic across continents as EEs. Given that different sectors in an index behave differently, a sector-wise analysis was conducted during the COVID-19 pandemic for the Indian stock market. The sector-wise results show that after the occurrence of EE, we have observed strong crashes surpassing $\mu+2*\sigma$ for an extended period for the banking sector. While for the pharmaceutical sector, no significant spikes were noted. Hence, TDA also proves successful in identifying the duration of shocks after the occurrence of EEs. This also indicates that the Banking sector continued to face stress and remained volatile even after the crash. This study gives us the applicability of TDA as a powerful analytical tool to study EEs in various fields.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCRISIS ALERT:Forecasting Stock Market Crisis Events Using Machine Learning Methods

Yue Chen, Xingyi Andrew, Salintip Supasanya

| Title | Authors | Year | Actions |

|---|

Comments (0)