Summary

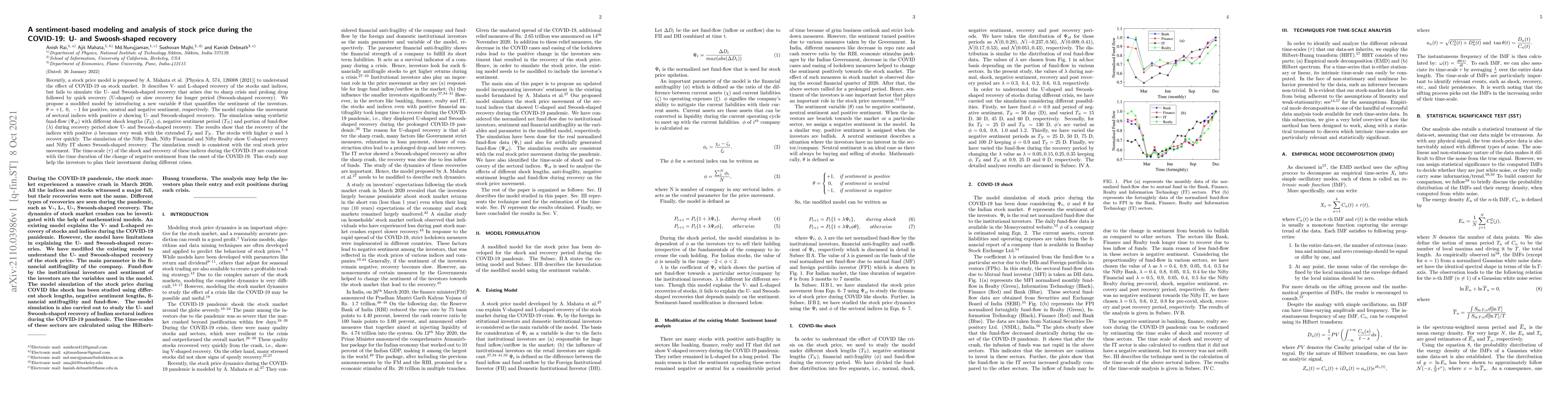

Recently, a stock price model is proposed by A. Mahata et al. [Physica A, 574, 126008 (2021)] to understand the effect of COVID-19 on stock market. It describes V- and L-shaped recovery of the stocks and indices, but fails to simulate the U- and Swoosh-shaped recovery that arises due to sharp crisis and prolong drop followed by quick recovery (U-shaped) or slow recovery for longer period (Swoosh-shaped recovery). We propose a modified model by introducing a new variable $\theta$ that quantifies the sentiment of the investors. $\theta=+1,~0,~-1$ for positive, neutral and negative sentiment, respectively. The model explains the movement of sectoral indices with positive $\phi$ showing U- and Swoosh-shaped recovery. The simulation using synthetic fund-flow ($\Psi_{st}$) with different shock lengths ($T_S$), $\phi$, negative sentiment period ($T_N$) and portion of fund-flow ($\lambda$) during recovery period show U- and Swoosh-shaped recovery. The results show that the recovery of the indices with positive $\phi$ becomes very weak with the extended $T_S$ and $T_N$. The stocks with higher $\phi$ and $\lambda$ recover quickly. The simulation of the Nifty Bank, Nifty Financial and Nifty Realty show U-shaped recovery and Nifty IT shows Swoosh-shaped recovery. The simulation result is consistent with the real stock price movement. The time-scale ($\tau$) of the shock and recovery of these indices during the COVID-19 are consistent with the time duration of the change of negative sentiment from the onset of the COVID-19. This study may help the investors to plan their investment during different crises.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMining the Relationship Between COVID-19 Sentiment and Market Performance

Ziyuan Xia, Jeffery Chen, Anchen Sun

| Title | Authors | Year | Actions |

|---|

Comments (0)