Summary

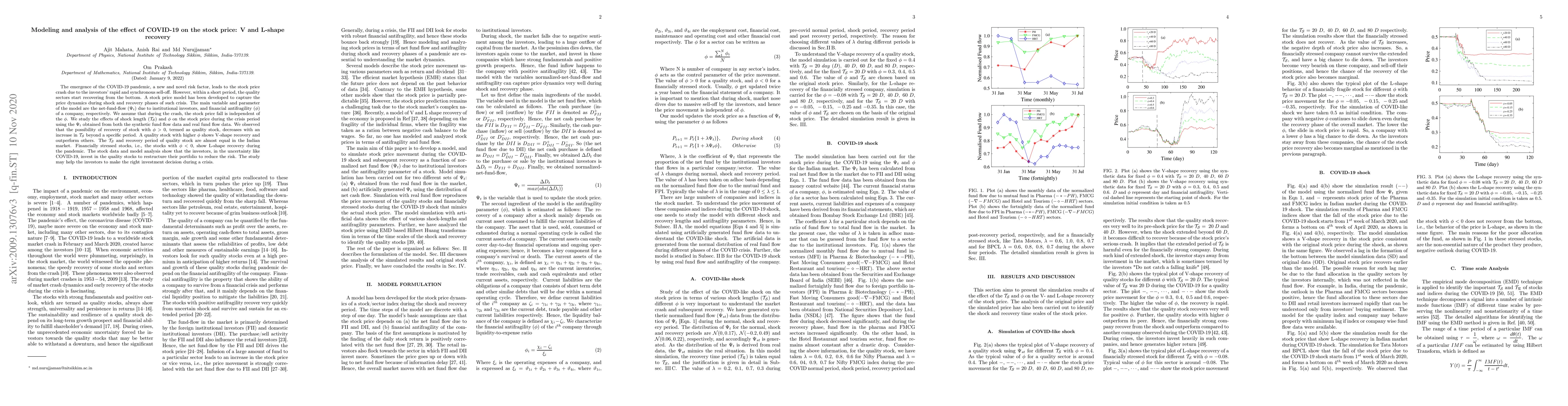

The emergence of the COVID-19 pandemic, a new and novel risk factor, leads to the stock price crash due to the investors' rapid and synchronous sell-off. However, within a short period, the quality sectors start recovering from the bottom. A stock price model has been developed during such crises based on the net-fund-flow ($\Psi_t$) due to institutional investors, and financial antifragility ($\phi$) of a company. We assume that during the crash, the stock price fall is independent of the $\phi$. We study the effects of shock lengths and $\phi$ on the stock price during the crises period using the $\Psi_t$ obtained from synthetic and real fund flow data. We observed that the possibility of recovery of stock with $\phi>0$, termed as quality stock, decreases with an increase in shock-length beyond a specific period. A quality stock with higher $\phi$ shows V-shape recovery and outperform others. The shock length and recovery period of quality stock are almost equal that is seen in the Indian market. Financially stressed stocks, i.e., the stocks with $\phi<0$, show L-shape recovery during the pandemic. The stock data and model analysis shows that the investors, in uncertainty like COVID-19, invest in quality stocks to restructure their portfolio to reduce the risk. The study may help the investors to make the right investment decision during a crisis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA sentiment-based modeling and analysis of stock price during the COVID-19: U- and Swoosh-shaped recovery

Sushovan Majhi, Anish Rai, Md. Nurujjaman et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)