Summary

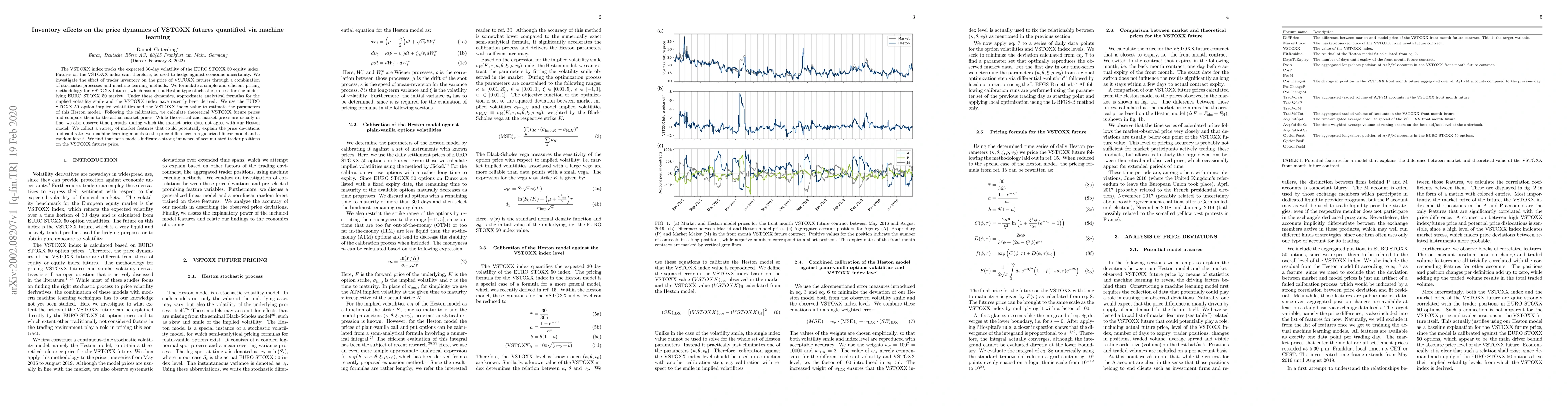

The VSTOXX index tracks the expected 30-day volatility of the EURO STOXX 50 equity index. Futures on the VSTOXX index can, therefore, be used to hedge against economic uncertainty. We investigate the effect of trader inventory on the price of VSTOXX futures through a combination of stochastic processes and machine learning methods. We formulate a simple and efficient pricing methodology for VSTOXX futures, which assumes a Heston-type stochastic process for the underlying EURO STOXX 50 market. Under these dynamics, approximate analytical formulas for the implied volatility smile and the VSTOXX index have recently been derived. We use the EURO STOXX 50 option implied volatilities and the VSTOXX index value to estimate the parameters of this Heston model. Following the calibration, we calculate theoretical VSTOXX future prices and compare them to the actual market prices. While theoretical and market prices are usually in line, we also observe time periods, during which the market price does not agree with our Heston model. We collect a variety of market features that could potentially explain the price deviations and calibrate two machine learning models to the price difference: a regularized linear model and a random forest. We find that both models indicate a strong influence of accumulated trader positions on the VSTOXX futures price.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnique futures in China: studys on volatility spillover effects of ferrous metal futures

Tingting Cao, Lin Hao, Weiqing Sun et al.

Electricity Price Forecasting: The Dawn of Machine Learning

Rafał Weron, Jesus Lago, Grzegorz Marcjasz et al.

Learning an Inventory Control Policy with General Inventory Arrival Dynamics

Sham Kakade, Kari Torkkola, Dhruv Madeka et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)