Summary

We consider forecasting a single time series using a large number of predictors in the presence of a possible nonlinear forecast function. Assuming that the predictors affect the response through the latent factors, we propose to first conduct factor analysis and then apply sufficient dimension reduction on the estimated factors, to derive the reduced data for subsequent forecasting. Using directional regression and the inverse third-moment method in the stage of sufficient dimension reduction, the proposed methods can capture the non-monotone effect of factors on the response. We also allow a diverging number of factors and only impose general regularity conditions on the distribution of factors, avoiding the undesired time reversibility of the factors by the latter. These make the proposed methods fundamentally more applicable than the sufficient forecasting method in Fan et al. (2017). The proposed methods are demonstrated in both simulation studies and an empirical study of forecasting monthly macroeconomic data from 1959 to 2016. Also, our theory contributes to the literature of sufficient dimension reduction, as it includes an invariance result, a path to perform sufficient dimension reduction under the high-dimensional setting without assuming sparsity, and the corresponding order-determination procedure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

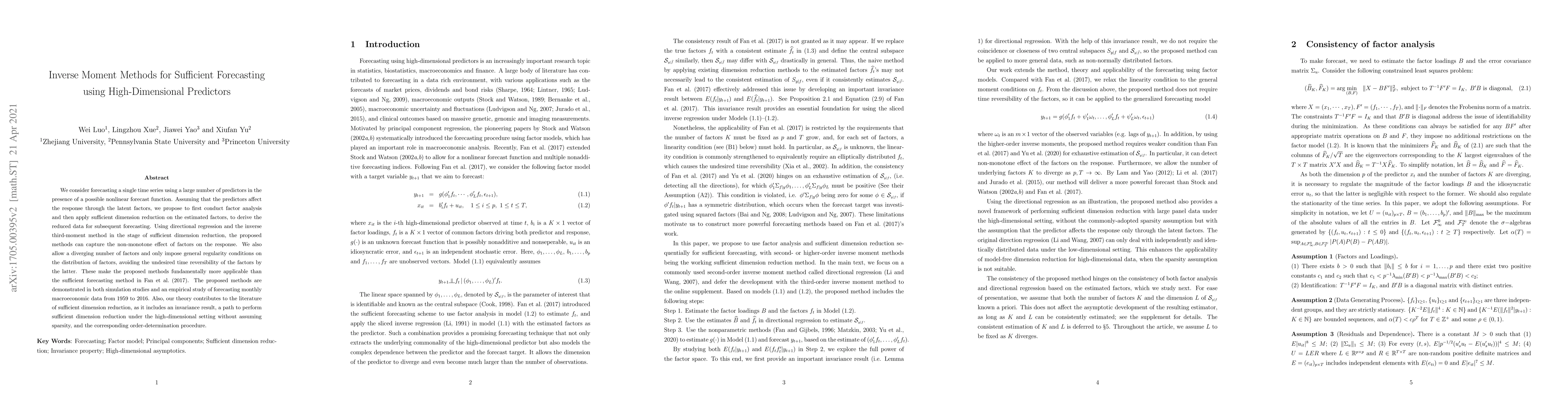

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)