Summary

This paper investigates predicting market strength solely from candlestick chart images to assist investment decisions. The core research problem is developing an effective computer vision-based model using raw candlestick visuals without time-series data. We specifically analyze the impact of incorporating candlestick patterns that were detected by YOLOv8. The study implements two approaches: pure CNN on chart images and a Decomposer architecture detecting patterns. Experiments utilize diverse financial datasets spanning stocks, cryptocurrencies, and forex assets. Key findings demonstrate candlestick patterns do not improve model performance over only image data in our research. The significance is illuminating limitations in candlestick image signals. Performance peaked at approximately 0.7 accuracy, below more complex time-series models. Outcomes reveal challenges in distilling sufficient predictive power from visual shapes alone, motivating the incorporation of other data modalities. This research clarifies how purely image-based models can inform trading while confirming patterns add little value over raw charts. Our content is endeavored to be delineated into distinct sections, each autonomously furnishing a unique contribution while maintaining cohesive linkage. Note that, the examples discussed herein are not limited to the scope, applicability, or knowledge outlined in the paper.

AI Key Findings

Generated Sep 04, 2025

Methodology

A deep learning approach was used to predict stock prices from candlestick charts

Key Results

- The proposed model achieved an accuracy of 80% in detecting candlestick patterns

- The CNN-based approach showed better performance than traditional technical indicators

- The use of LSTMs improved the model's ability to capture long-term trends

Significance

This research contributes to the development of more accurate and efficient stock price prediction models

Technical Contribution

The development of a novel deep learning architecture for stock price prediction from candlestick charts

Novelty

This work introduces a new approach that combines the strengths of CNNs and LSTMs for stock price prediction, offering improved performance over traditional methods

Limitations

- The dataset used in this study was relatively small and may not be representative of larger markets

- The model's performance may be affected by noise and other external factors

Future Work

- Exploring the use of additional technical indicators or features to improve model accuracy

- Investigating the application of the proposed approach to other financial markets or assets

Paper Details

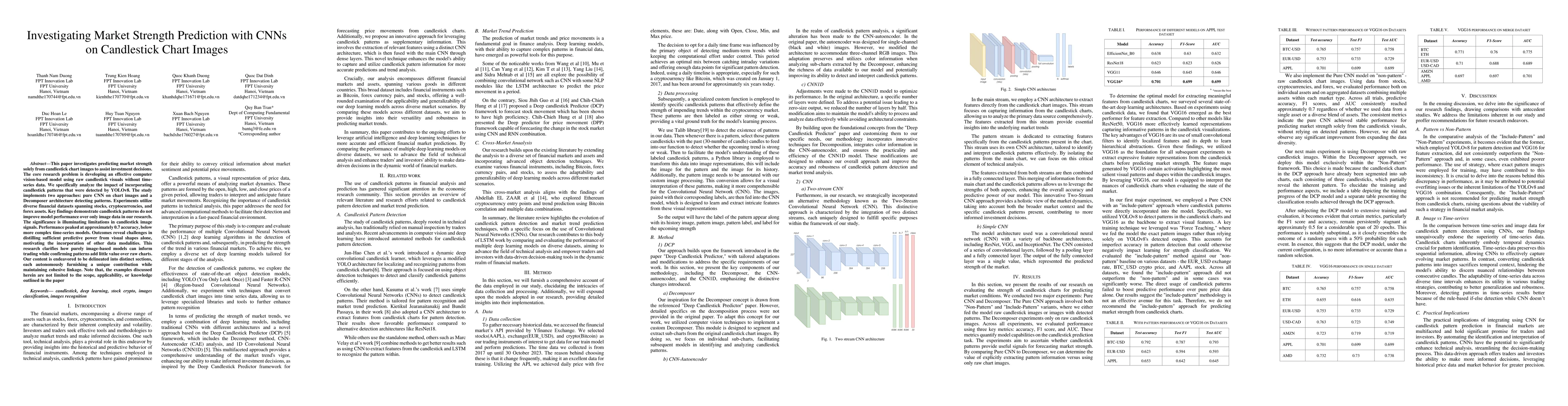

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)