Summary

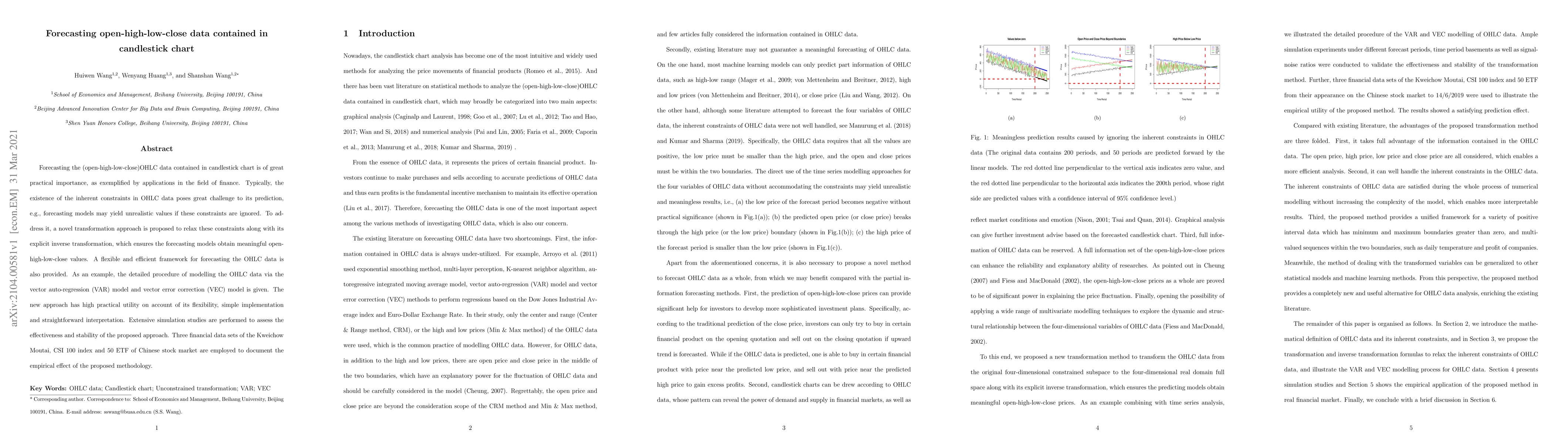

Forecasting the (open-high-low-close)OHLC data contained in candlestick chart is of great practical importance, as exemplified by applications in the field of finance. Typically, the existence of the inherent constraints in OHLC data poses great challenge to its prediction, e.g., forecasting models may yield unrealistic values if these constraints are ignored. To address it, a novel transformation approach is proposed to relax these constraints along with its explicit inverse transformation, which ensures the forecasting models obtain meaningful openhigh-low-close values. A flexible and efficient framework for forecasting the OHLC data is also provided. As an example, the detailed procedure of modelling the OHLC data via the vector auto-regression (VAR) model and vector error correction (VEC) model is given. The new approach has high practical utility on account of its flexibility, simple implementation and straightforward interpretation. Extensive simulation studies are performed to assess the effectiveness and stability of the proposed approach. Three financial data sets of the Kweichow Moutai, CSI 100 index and 50 ETF of Chinese stock market are employed to document the empirical effect of the proposed methodology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInvestigating Market Strength Prediction with CNNs on Candlestick Chart Images

Thanh Nam Duong, Trung Kien Hoang, Quoc Khanh Duong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)