Summary

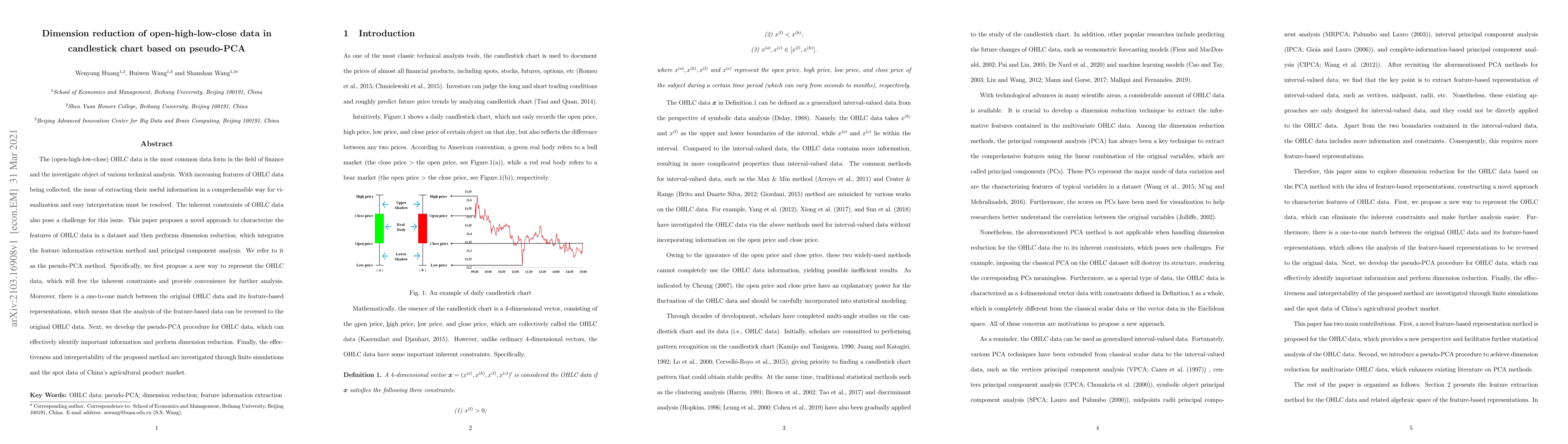

The (open-high-low-close) OHLC data is the most common data form in the field of finance and the investigate object of various technical analysis. With increasing features of OHLC data being collected, the issue of extracting their useful information in a comprehensible way for visualization and easy interpretation must be resolved. The inherent constraints of OHLC data also pose a challenge for this issue. This paper proposes a novel approach to characterize the features of OHLC data in a dataset and then performs dimension reduction, which integrates the feature information extraction method and principal component analysis. We refer to it as the pseudo-PCA method. Specifically, we first propose a new way to represent the OHLC data, which will free the inherent constraints and provide convenience for further analysis. Moreover, there is a one-to-one match between the original OHLC data and its feature-based representations, which means that the analysis of the feature-based data can be reversed to the original OHLC data. Next, we develop the pseudo-PCA procedure for OHLC data, which can effectively identify important information and perform dimension reduction. Finally, the effectiveness and interpretability of the proposed method are investigated through finite simulations and the spot data of China's agricultural product market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInvestigating Market Strength Prediction with CNNs on Candlestick Chart Images

Thanh Nam Duong, Trung Kien Hoang, Quoc Khanh Duong et al.

No citations found for this paper.

Comments (0)