Authors

Summary

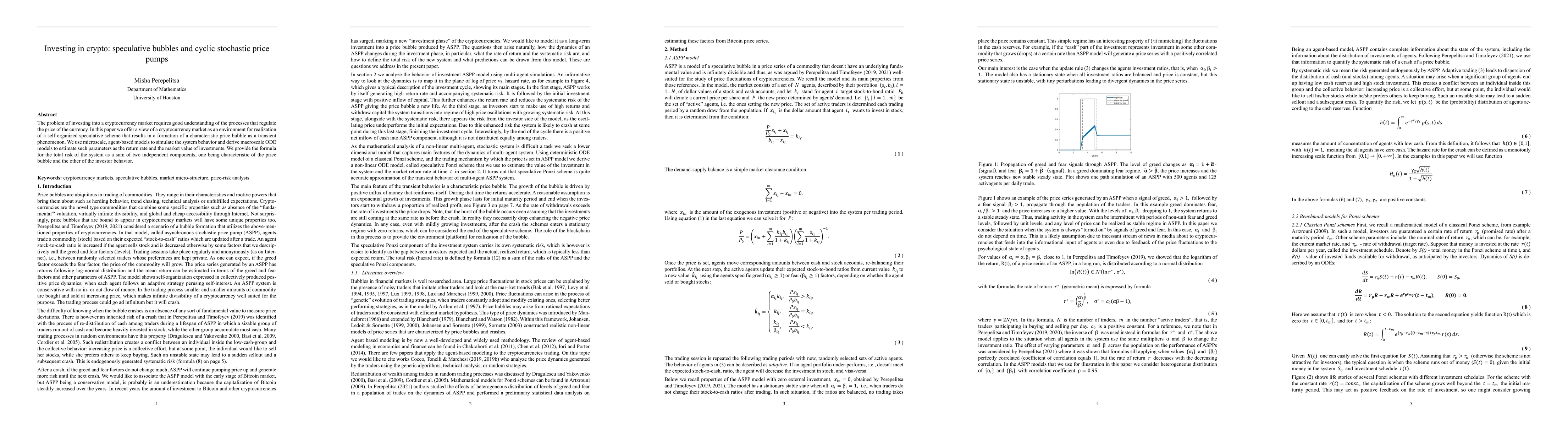

The problem of investing into a cryptocurrency market requires good understanding of the processes that regulate the price of the currency. In this paper we offer a view of a cryptocurrency market as an environment for realization of a self-organized speculative scheme that results in a formation of a characteristic price bubble as a transient phenomenon. We use microscale, agent-based models to simulate the system behavior and derive macroscale ODE models to estimate such parameters as the return rate and the market value of investments. We provide the formula for the total risk of the system as a sum of two independent components, one being characteristic of the price bubble and the other of the investor behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)