Summary

We investigate a randomization procedure undertaken in real option games which can serve as a basic model of regulation in a duopoly model of preemptive investment. We recall the rigorous framework of [M. Grasselli, V. Lecl\`ere and M. Ludkovsky, Priority Option: the value of being a leader, International Journal of Theoretical and Applied Finance, 16, 2013], and extend it to a random regulator. This model generalizes and unifies the different competitive frameworks proposed in the literature, and creates a new one similar to a Stackelberg leadership. We fully characterize strategic interactions in the several situations following from the parametrization of the regulator. Finally, we study the effect of the coordination game and uncertainty of outcome when agents are risk-averse, providing new intuitions for the standard case.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

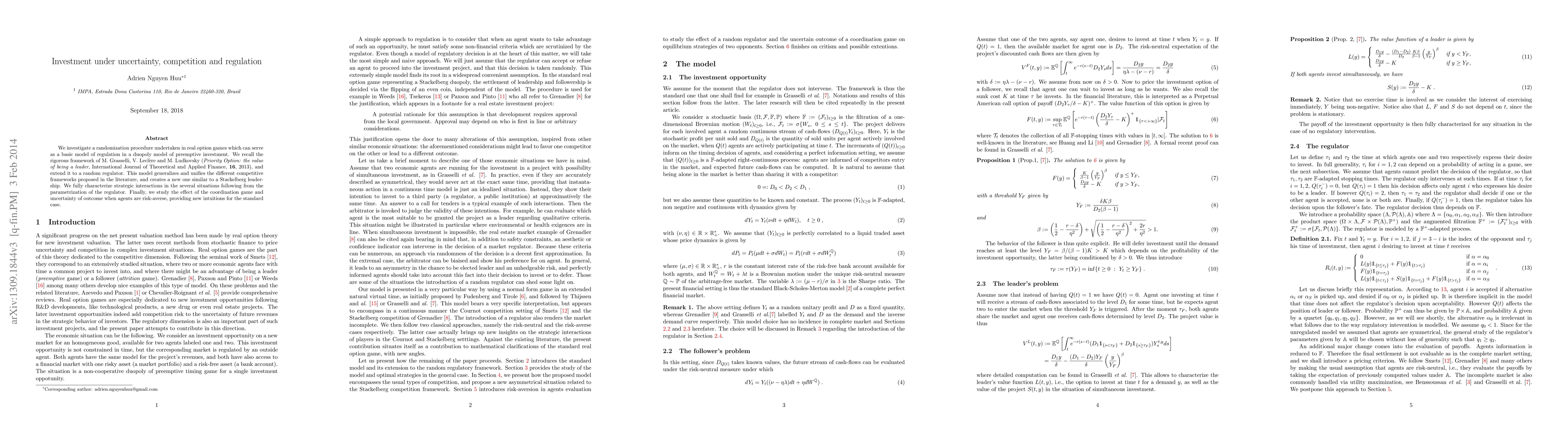

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)