Authors

Summary

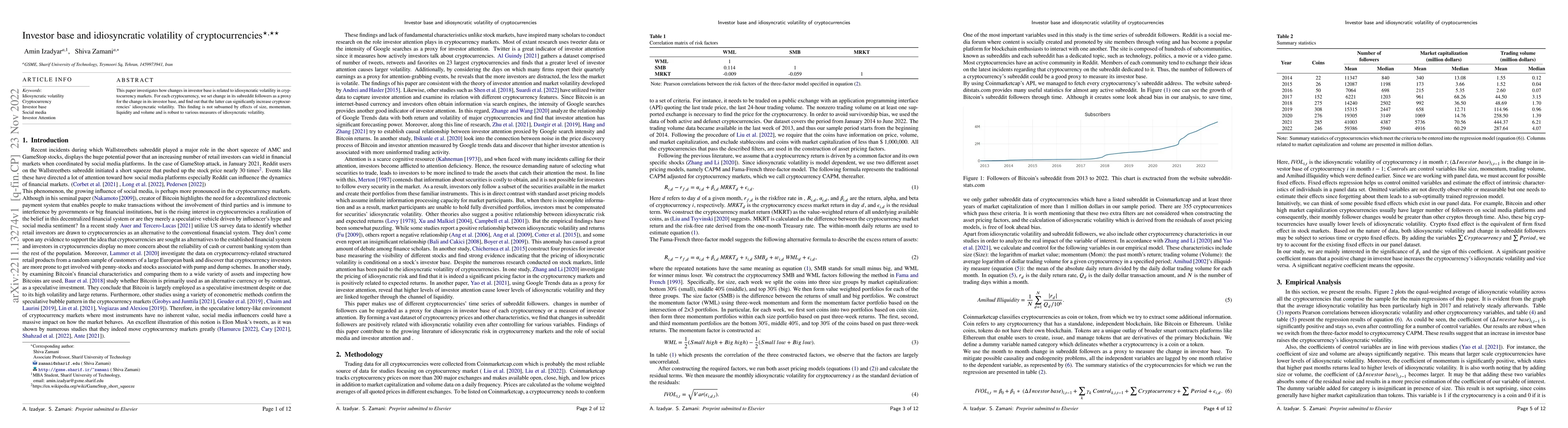

This paper investigates how changes in investor base is related to idiosyncratic volatility in cryptocurrency markets. For each cryptocurrency, we set change in its subreddit followers as a proxy for the change in its investor base, and find out that the latter can significantly increase cryptocurrencies idiosyncratic volatility. This finding is not subsumed by effects of size, momentum, liquidity and volume and is robust to various measures of idiosyncratic volatility.

AI Key Findings

Generated Sep 07, 2025

Methodology

The study uses changes in a cryptocurrency's subreddit followers as a proxy for changes in its investor base, examining the relationship with idiosyncratic volatility in cryptocurrency markets. Control variables include size, momentum, liquidity, and volume.

Key Results

- Changes in investor base significantly increase cryptocurrencies' idiosyncratic volatility.

- This finding is robust and not subsumed by effects of size, momentum, liquidity, and volume.

Significance

This research contributes to the growing literature on cryptocurrency idiosyncratic volatility and highlights the influence of social media platforms, particularly Reddit, on financial market dynamics.

Technical Contribution

The paper employs panel data fixed-effects regression to analyze the relationship between investor base changes and idiosyncratic volatility in cryptocurrencies.

Novelty

This research is novel in linking changes in investor base, as measured by subreddit followers, to idiosyncratic volatility in cryptocurrency markets, providing evidence of the growing influence of social media on financial market dynamics.

Limitations

- The study does not explore the underlying reasons for the relationship between investor base changes and idiosyncratic volatility.

- The analysis does not account for potential external shocks or events impacting cryptocurrency markets.

Future Work

- Investigate the mechanisms through which changes in investor base affect idiosyncratic volatility.

- Explore the impact of other social media platforms on cryptocurrency markets.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-sectional Dependence in Idiosyncratic Volatility

Ilze Kalnina, Kokouvi Tewou

Liquidity Costs, Idiosyncratic Volatility and Expected Stock Returns

M. Reza Bradrania, Maurice Peat, Stephen Satchell

Factor and Idiosyncratic VAR-Ito Volatility Models for Heavy-Tailed High-Frequency Financial Data

Jianqing Fan, Donggyu Kim, Minseok Shin et al.

No citations found for this paper.

Comments (0)