Summary

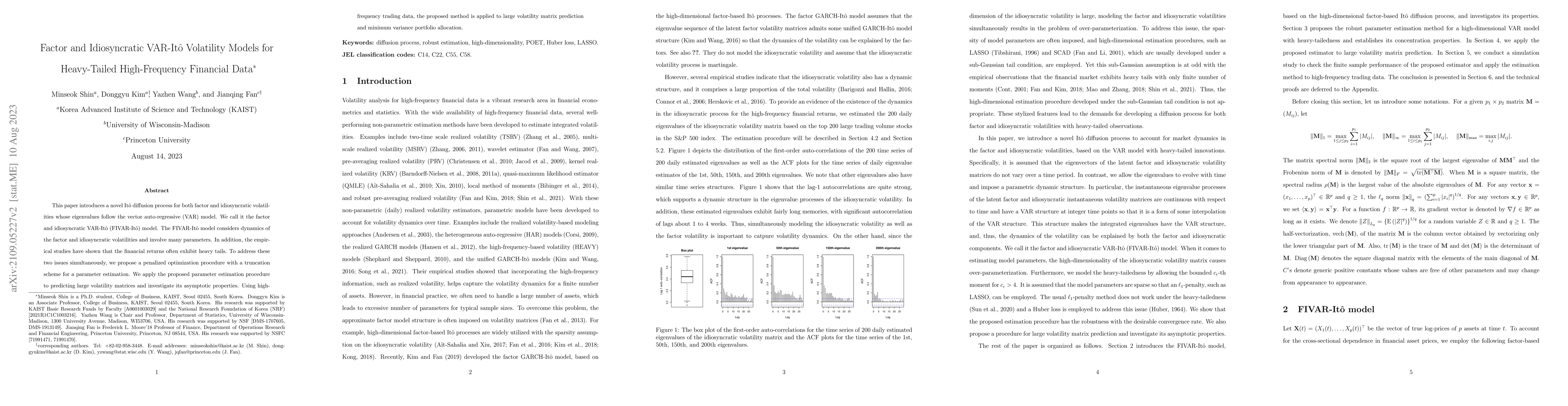

This paper introduces a novel It\^{o} diffusion process for both factor and idiosyncratic volatilities whose eigenvalues follow the vector auto-regressive (VAR) model. We call it the factor and idiosyncratic VAR-It\^{o} (FIVAR-It\^o) model. The FIVAR-It\^o model considers dynamics of the factor and idiosyncratic volatilities and involve many parameters. In addition, the empirical studies have shown that the financial returns often exhibit heavy tails. To address these two issues simultaneously, we propose a penalized optimization procedure with a truncation scheme for a parameter estimation. We apply the proposed parameter estimation procedure to predicting large volatility matrices and investigate its asymptotic properties. Using high-frequency trading data, the proposed method is applied to large volatility matrix prediction and minimum variance portfolio allocation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVolatility Models for Stylized Facts of High-Frequency Financial Data

Donggyu Kim, Minseok Shin

Factor Models with Sparse VAR Idiosyncratic Components

Luca Margaritella, Jonas Krampe

| Title | Authors | Year | Actions |

|---|

Comments (0)