Authors

Summary

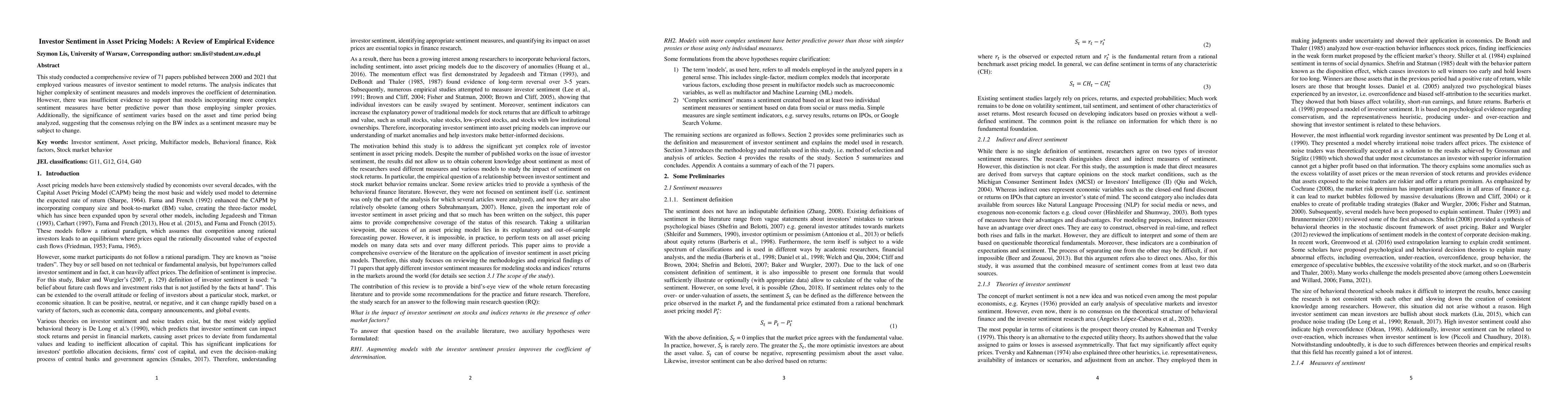

This study conducted a comprehensive review of 71 papers published between 2000 and 2021 that employed various measures of investor sentiment to model returns. The analysis indicates that higher complexity of sentiment measures and models improves the coefficient of determination. However, there was insufficient evidence to support that models incorporating more complex sentiment measures have better predictive power than those employing simpler proxies. Additionally, the significance of sentiment varies based on the asset and time period being analyzed, suggesting that the consensus relying on the BW index as a sentiment measure may be subject to change.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandomized Control in Performance Analysis and Empirical Asset Pricing

Elias Tsigaridas, Cyril Bachelard, Apostolos Chalkis et al.

Deep Partial Least Squares for Empirical Asset Pricing

Nicholas G. Polson, Matthew F. Dixon, Kemen Goicoechea

No citations found for this paper.

Comments (0)