Summary

Decentralized finance (DeFi) has the potential to disrupt centralized finance by validating peer-to-peer transactions through tamper-proof smart contracts, thus significantly lowering the transaction cost charged by financial intermediaries. However, the actual realization of peer-to-peer transactions and the levels and effects of decentralization are largely unknown. Our research pioneers a blockchain network study that applies social network analysis to measure the level, dynamics, and impacts of decentralization in DeFi token transactions on the Ethereum blockchain. First, we find a significant core-periphery structure in the AAVE token transaction network where the cores include the two largest centralized crypto exchanges. Second, we provide evidence that multiple network features consistently characterize decentralization dynamics. Finally, we document that a more decentralized network significantly predicts a higher return and lower volatility of the decentralized market of AAVE tokens on the Ethereum blockchain. We point out that our approach is seminal for inspiring future extensions related to the facets of application scenarios, research questions, and methodologies on the mechanics of blockchain decentralization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

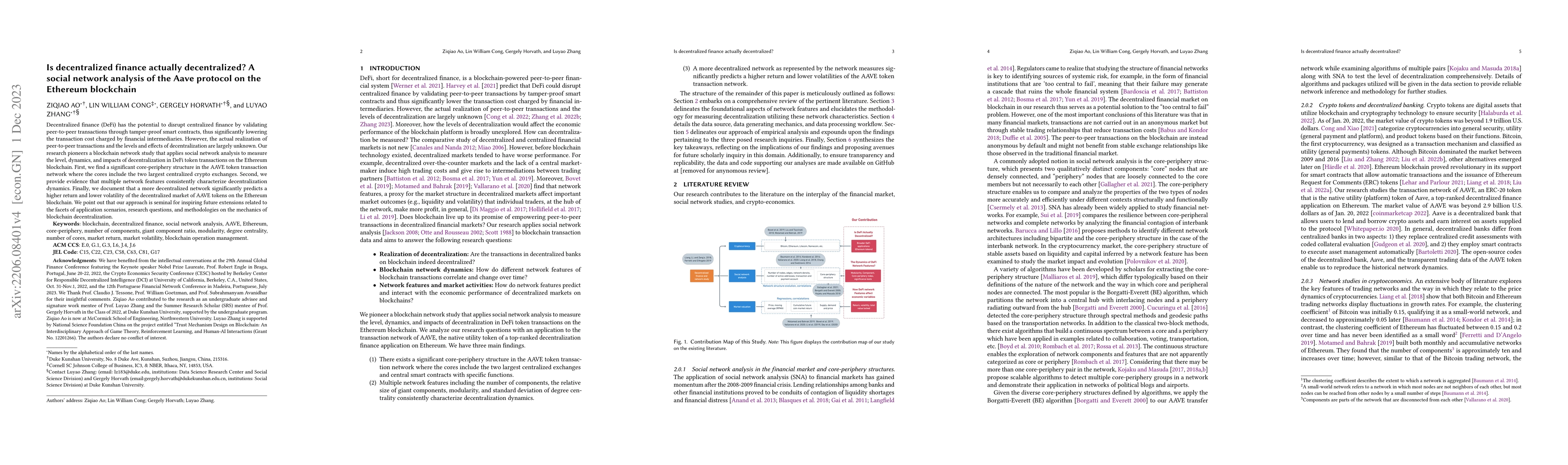

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBlockchain Network Analysis: A Comparative Study of Decentralized Banks

Yufan Zhang, Yutong Sun, Yulin Liu et al.

DeSocial: Blockchain-based Decentralized Social Networks

Yongfeng Zhang, Xi Zhu, Minghao Guo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)