Summary

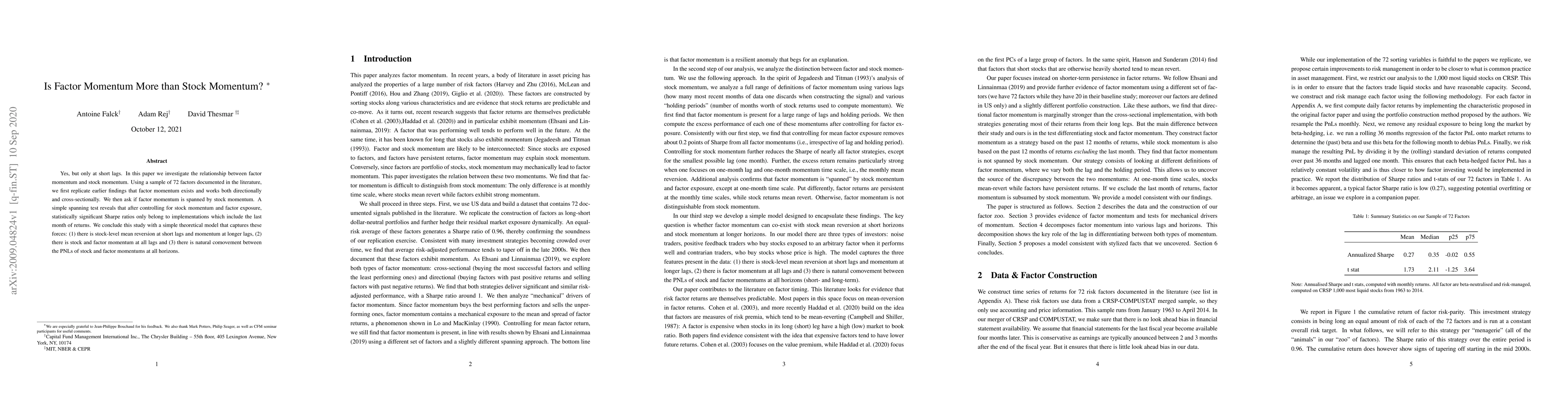

Yes, but only at short lags. In this paper we investigate the relationship between factor momentum and stock momentum. Using a sample of 72 factors documented in the literature, we first replicate earlier findings that factor momentum exists and works both directionally and cross-sectionally. We then ask if factor momentum is spanned by stock momentum. A simple spanning test reveals that after controlling for stock momentum and factor exposure, statistically significant Sharpe ratios only belong to implementations which include the last month of returns. We conclude this study with a simple theoretical model that captures these forces: (1) there is stock-level mean reversion at short lags and momentum at longer lags, (2) there is stock and factor momentum at all lags and (3) there is natural comovement between the PNLs of stock and factor momentums at all horizons.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)