Summary

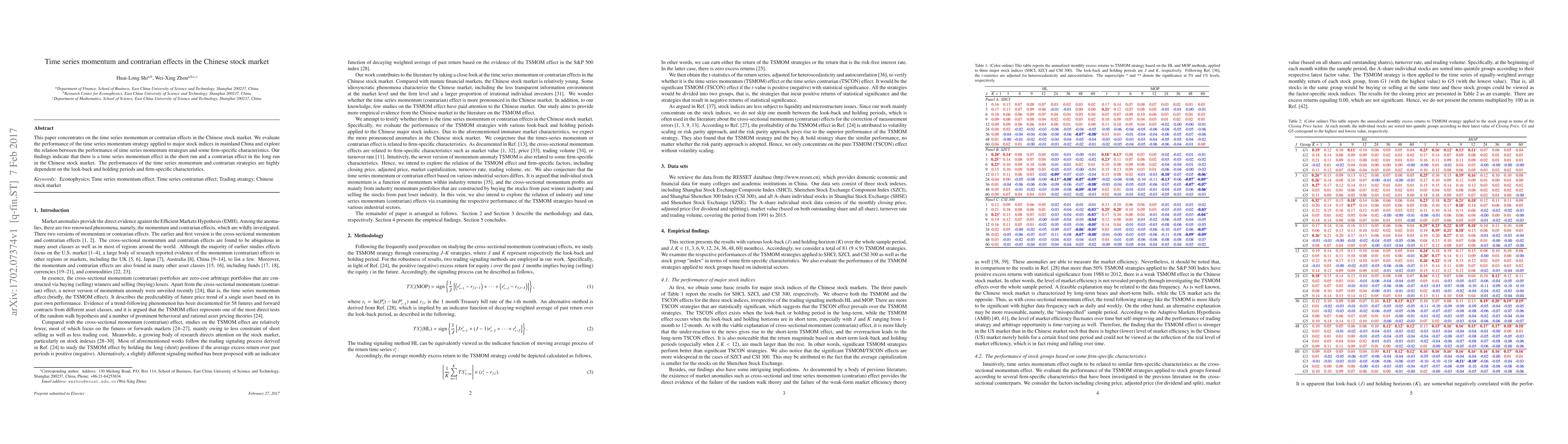

This paper concentrates on the time series momentum or contrarian effects in the Chinese stock market. We evaluate the performance of the time series momentum strategy applied to major stock indices in mainland China and explore the relation between the performance of time series momentum strategies and some firm-specific characteristics. Our findings indicate that there is a time series momentum effect in the short run and a contrarian effect in the long run in the Chinese stock market. The performances of the time series momentum and contrarian strategies are highly dependent on the look-back and holding periods and firm-specific characteristics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)