Summary

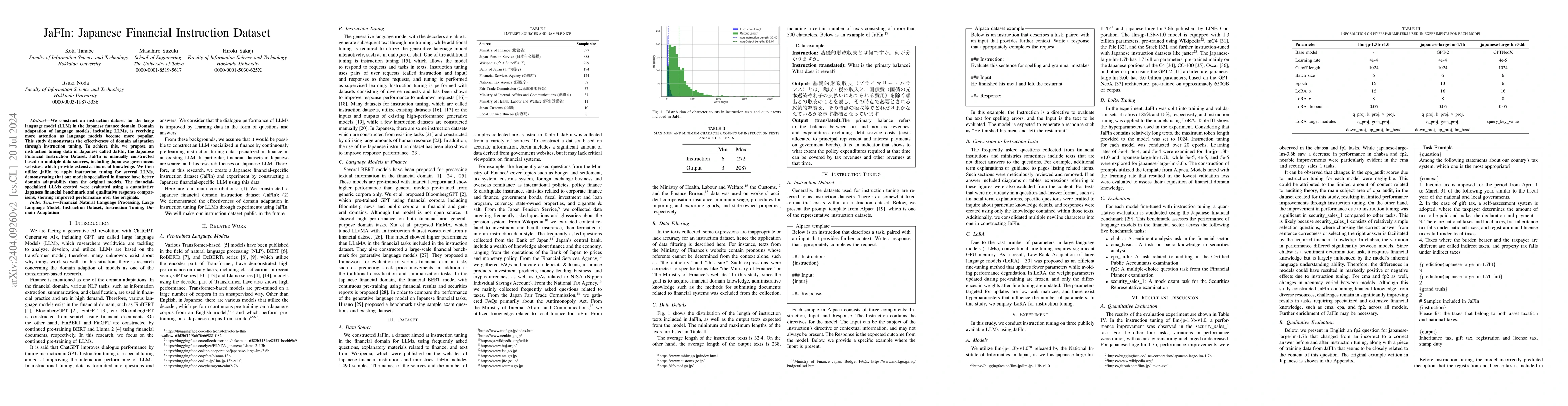

We construct an instruction dataset for the large language model (LLM) in the Japanese finance domain. Domain adaptation of language models, including LLMs, is receiving more attention as language models become more popular. This study demonstrates the effectiveness of domain adaptation through instruction tuning. To achieve this, we propose an instruction tuning data in Japanese called JaFIn, the Japanese Financial Instruction Dataset. JaFIn is manually constructed based on multiple data sources, including Japanese government websites, which provide extensive financial knowledge. We then utilize JaFIn to apply instruction tuning for several LLMs, demonstrating that our models specialized in finance have better domain adaptability than the original models. The financial-specialized LLMs created were evaluated using a quantitative Japanese financial benchmark and qualitative response comparisons, showing improved performance over the originals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom Base to Conversational: Japanese Instruction Dataset and Tuning Large Language Models

Hiroki Sakaji, Masahiro Suzuki, Masanori Hirano

EDINET-Bench: Evaluating LLMs on Complex Financial Tasks using Japanese Financial Statements

Taro Makino, David Ha, Takashi Ishida et al.

llm-japanese-dataset v0: Construction of Japanese Chat Dataset for Large Language Models and its Methodology

Hiroki Sakaji, Masahiro Suzuki, Masanori Hirano

AnswerCarefully: A Dataset for Improving the Safety of Japanese LLM Output

Takashi Kodama, Satoshi Sekine, Satoru Katsumata et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)